Despite the potential trade barriers and uncertainty caused by the EU’s tariffs on foreign electric vehicle (EV) makers in China, including Tesla, China’s advantages in terms of both market and manufacturing capacity will continue to position it as a crucial component of the global strategy for foreign automakers.

EU inspectors visited Tesla’s operations in Shanghai last week, which could result in Tesla getting a lower tariff rate than the average rate on Chinese EV makers, Politico reported on Wednesday, citing a note from the bloc’s trade arm.

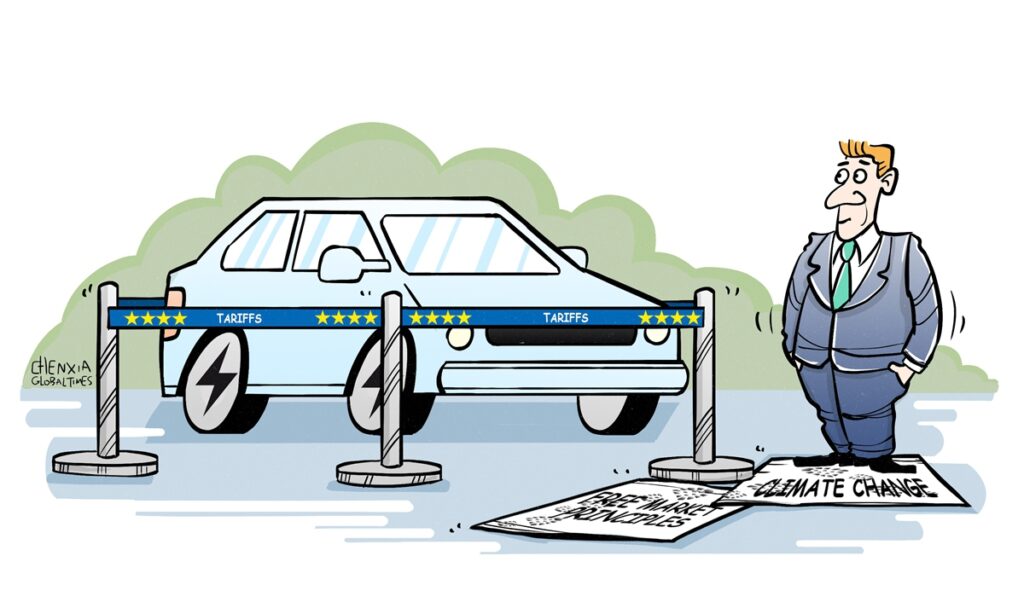

China on Thursday urged the EU to show sincerity and advance consultations over tariffs on Chinese EVs, as the European Commission (EC), the EU’s executive arm, confirmed its provisional import tariffs on Chinese EVs from Thursday, despite strong opposition from officials and industry players within the bloc.

The EC initially did not select Tesla for visits in the anti-subsidy investigation into Chinese EVs, but the company then applied to receive individual treatment and had that request granted, according to the Politico report.

Indeed, ever since the EU announced last month its decision to impose provisional tariffs on Chinese EV imports, the tariff rate that could be levied on Tesla and other foreign EV makers in China for Chinese-made EVs they export to the EU has garnered attention and triggered speculation.

However, competition in the auto market has already evolved globally, extending beyond a single region. For instance, while Tesla is reportedly the largest exporter of EVs from China to the EU, its Chinese-made Model 3 and Model Y have also been exported to the Asia-Pacific and other regions in large quantities, such as to South Korea, Australia, Singapore and the Middle East.

In this sense, regardless of the impact the EU tariff may have on Tesla or other foreign automakers in China, it is unlikely to diminish the attractiveness of China’s auto market and its receptiveness to foreign investment.

Under such circumstances, it is also essential for European car makers to seek global expansion in key markets like China and the US if they want to develop further. But if the EU relies solely on tariff barriers to create market division and protect its own companies, it will not only hinder their own growth but also risk them missing out on opportunities to keep up with progress in the global auto industry. In the era of globalization, protectionism is not a sustainable approach to safeguard market share, rather, it will only result in the loss of more share to competitors.

In the global auto industry competition, an open market and innovative technology will serve as key driving forces to propel the development of the entire industry. And China, as a crucial component of the global auto sector, occupies an irreplaceable position.

First of all, as one of the world’s largest auto markets, China’s huge market size and consumption potential has always been a key factor in attracting foreign automakers. The growth potential of the market is evident not just in sales, but also in the increasing consumer acceptance of new technologies and models, particularly in the new energy vehicle sector. In 2023, China’s new-energy vehicle sales reached 9.49 million, up 37.9 percent year-on-year, according to the China Association of Automobile Manufacturers.

Moreover, China has a comprehensive automotive industry and supply chain, spanning from raw materials to parts production and vehicle assembly. This not only guarantees high production efficiency but also lowers costs. Despite potential tariffs, these cost advantages are still attractive conditions for automakers.

Furthermore, the Chinese government has been actively promoting opening-up and innovation in the auto sector. For instance, Xin Guobin, vice minister of the Ministry of Industry and Information Technology (MIIT), said that the ministry is implementing measures to fully remove restrictions on foreign investment in the manufacturing industry. Starting from 2022, China already allowed full foreign ownership of passenger car manufacturing in the country.

It is against this background that the investment case by foreign automakers in China is on the rise, particularly in the new-energy vehicles sector. The BMW iX3, the first locally-produced BEV launched at the end of 2020, is available for the Chinese market as well as for the European market. Volkswagen said it would invest about $700 million for 4.99 percent of Xpeng, and it aims to launch 30 new EV models in China in next 6 years.

Therefore, despite the challenges, there is no doubt that foreign automakers will continue to capitalize on the opportunities China presents for growth and innovation. And China’s auto manufacturing and market will remain open, thereby strengthening its position in global auto development.

Global Times