While China’s optimization of epidemic response measures will boost the country’s economic growth, it is important to note that such economic boost next year will unlikely hit the international gas market.

A Bloomberg article entitled “China’s Covid Pivot Set to Worsen the Global Energy Crunch” stated on Wednesday that as a result of China’s optimization of anti-COVID-19 measures, the nation’s gas imports could rebound, potentially curbing liquified natural gas (LNG) supply to Europe and other Asian nations.

China surpassed Japan to become the world’s largest LNG importer last year, but it would be unfair to brand China’s economic recovery as exacerbating the global energy crisis in that the nation is not a key factor in the dramatic changes in the global energy landscape over the past several months.

It is true that prices of major energy commodities such as oil and gas have seen increased volatility this year, which is due in large part to the extreme shortage of non-Russian energy supplies caused by Western sanctions against Russia over its conflict with Ukraine.

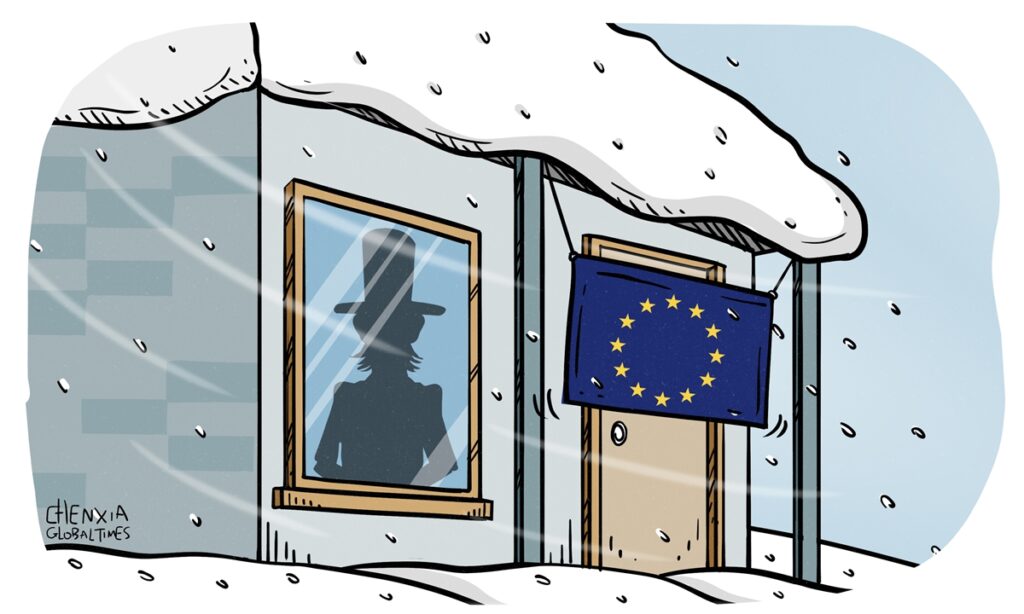

At present, the European gas market remains the epicenter of the current energy crisis, despite correction seen in oil prices amid global economic slowdown and the US Federal Reserve’s tightening monetary policy. As the proportion of Russian gas to Europe’s total imports decreased from 45 percent in 2021 to a current 9 percent, it is inevitable for Europe’s energy supply to face serious challenges this winter and next year.

Moreover, since Europe has to import LNG from the US, Norway and other producers, energy supplies in emerging countries have also been affected due to the high import costs.

There is no denying that as a result of China’s optimized epidemic prevention measures, its economy will gradually shake off the impact of the epidemic, which will indeed lead to certain increase in demand for energy products such as natural gas and oil. But that doesn’t necessarily mean China’s demand will worsen global energy crunch. Disturbing the global energy supply pattern is the root cause why the current energy crisis continues with no end in sight.

One of the most direct manifestations of tight energy supplies is price increase. According to data from Chinese customs, in the first 11 months of this year, China’s natural gas imports fell 9.7 percent year-on-year in terms of volume while surging 32.8 percent in terms of value.

The figures are sufficient to suggest that Chinese demand is not the main factor contributing to energy supply shortages. This is because China mainly import LNG through long-term agreements, which are conducive not only to ensure its own energy supply security but also to keep supply and demand stable across the global market. For instance, last month, China signed a landmark 27-year agreement for purchases of four million tons of LNG a year from Qatar.

For a long time, China has acted as a major stabilizing force in the global energy consumption market. Energy trade not only supports the operation of China’s national economy, but also is an important area for China to develop mutually beneficial economic and trade relations with its trading partners.

With renewed economic vigor stimulated by China’s optimization of anti-COVID-19 measures, China will certainly continue to strengthen trade cooperation with major energy exporters in the future. Also, China’s domestic production of natural gas is rising steadily and will continue to rise next year. Even if imports increase, it will not affect the international market by too much.

(Global Times)