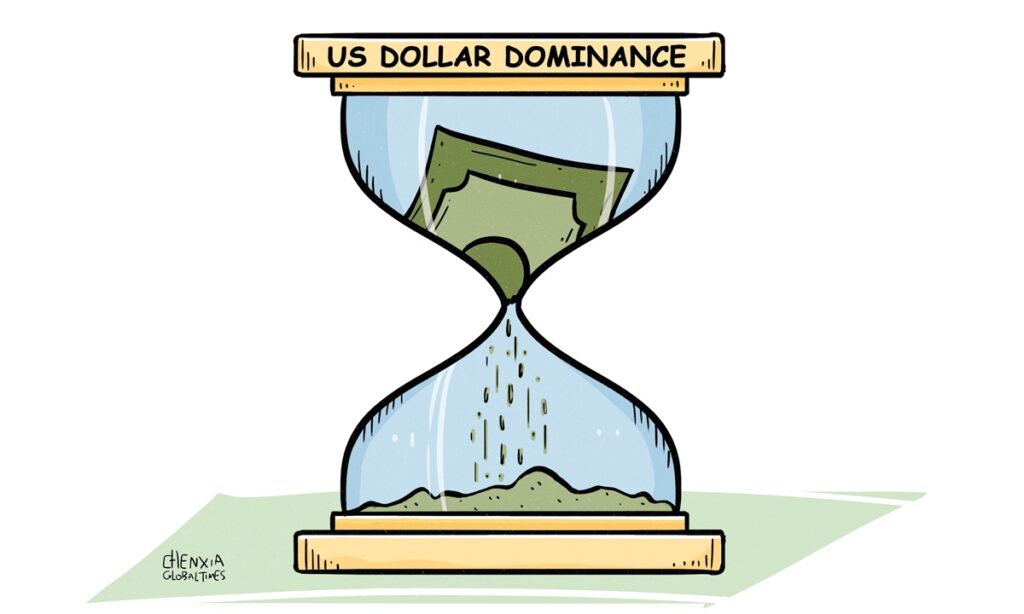

As the US Federal Reserve’s monetary tightening policy is set to wreak havoc and cause shocks across the global economy, there is increasing urgency for China, Russia, and other economies to step up cooperation to break the US dollar’s dominance in the energy market.

The dollar has been strengthening against the world’s other major currencies, and it has reached a level not seen in almost two decades. As the US central bank keeps raising federal funds rates to curb runaway inflation, the dollar is set to continue to appreciate significantly in the coming months.

In Europe, the euro has fallen below parity with the dollar, reaching its lowest level in 20 years. In Asia, the Japanese yen has been traded at around 140 per dollar, which nears a 24-year low. Sharp currency depreciations will bring more pain and risks for non-dollar economies, including the EU, Japan and others.

In the global energy markets, commodities such as crude oil and natural gas are usually traded in US dollars. A strong dollar means energy products will become more expensive in terms of other currencies. When energy and raw material prices rise, the prices of other products will go up, leading to high inflation globally. The only exception will be the US where a strong dollar makes imported goods cheaper, thus helping keep its inflation in check.

The reason why the US can, time and again, export its own inflation crisis caused by its previous monetary easing policy to the world is mainly because the dollar still holds the dominant position in the global foreign exchange market, reserve assets, trade settlement and other fields.

To break the dollar’s dominance, it is essential to first weaken its anchor with major energy products such as crude oil. With the Fed’s irresponsible monetary policy now plunging the world economy into a tempest, more countries have been waking up to the growing urgency of breaking the dollar’s dominance in global energy trading. It has become more frequent than ever to see crude oil producing countries and consuming countries use non-dollar currencies to settle their energy trade in recent months.

For instance, Russia has sought payment in United Arab Emirates dirhams for oil exports to some Indian customers, Reuters reported in July. In the same month, India’s central bank announced an arrangement to allow trade settlements between India and other countries in rupee. And, Saudi Arabia has been in discussions with China about pricing some Saudi oil sales to China in yuan instead of dollar, according to a Wall Street Journal report.

Most recently, Russia’s Gazprom and China National Petroleum Corporation have agreed to switch payments for gas supplies to Russian ruble and the Chinese yuan instead of the US dollar. Oil and gas cooperation has always been the most fruitful and extensive area of practical cooperation between China and Russia. At present, Russia has become one of the main oil and gas supply sources for China, while China is also an important export market for Russian oil and gas.

During a recent visit to Russia, Li Zhanshu, chairman of China’s National People’s Congress (NPC) Standing Committee, said that the China-Russia comprehensive strategic partnership of coordination for the new era has maintained strong development momentum.

It is worth noting that as the global economy is facing growing shocks from the stronger dollar, China and Russia need not only to accelerate their cooperation in energy settlement by facilitating relevant coordination and negotiation mechanism, but also studying the possibility of integrating that exploration into the cooperation under the Shanghai Cooperation Organisation and the BRICS framework.

There is real and common need for both developing and developed economies to seek non-dollar settlement in their energy trade. It is time for the concerned economies to act and fully coordinate and experiment with the possibility.

(Global Times)