China on Tuesday reported a 27.1 percent year-on-year trade growth in the first half of 2021 following 13 consecutive months of growth, shrugging off mounting pressure from a set of challenges, including surging raw material prices, a resurgence of COVID-19 in China’s major export hubs and other external hurdles.

At an executive meeting of the State Council on Tuesday, Premier Li Keqiang called for policy coordination for the rest of 2021 and next year to keep economic growth at “a reasonable range,” vowing stable macroeconomic policies and more support for small and medium-sized enterprises (SMEs).

However, just as significant as the better-than-expected figures, Chinese officials and analysts warned of potentially slower growth in the second half of the year due to uncertain and unstable factors, confirming widespread market expectations for slower trade growth for the world’s second-largest economy following a world-leading rapid recovery from the COVID-19 pandemic.

Though challenges persist, especially for certain industries and SMEs, a slower growth in the second half is a sign of the Chinese economy returning in a safe manner rather than a sudden loss of momentum, analysts said, noting more policy support is still underway and a “safe landing” is all but guaranteed.

China is expected to release second-quarter GDP data on Thursday, with many seeing a sharp slowdown in growth from a record expansion of 18.3 percent in the first quarter to around 8 percent in the second quarter. Still, the full-year growth is expected to be slightly higher than normal.

Best figures

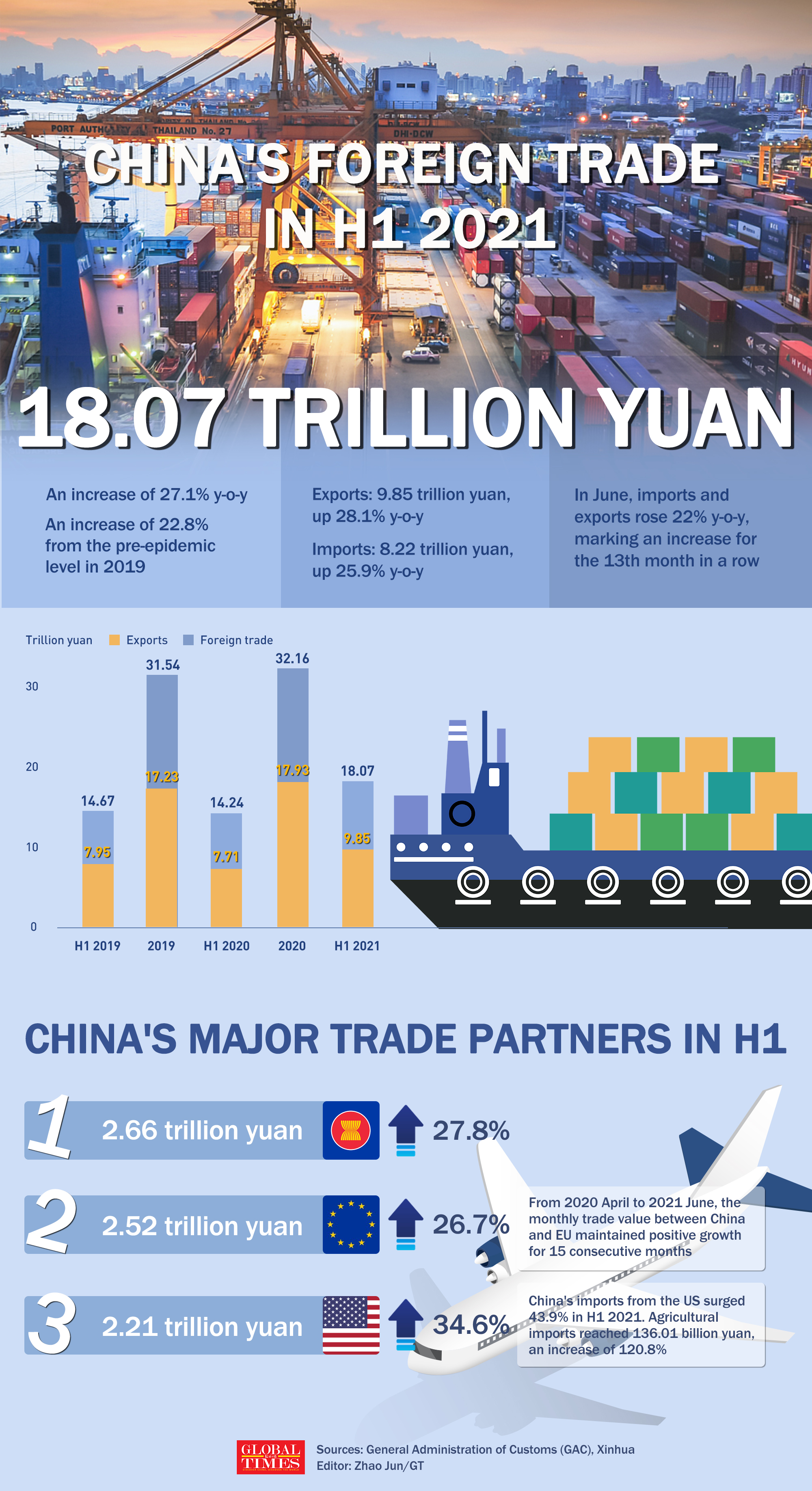

In the first half of the year, total trade surged 27.1 percent year-on-year to reach 18.07 trillion yuan ($2.8 trillion), with imports increasing 25.9 percent year-on-year and exports growing 28.1 percent, according to data from the General Administration of Customs (GAC) on Tuesday.

In June, when the challenges were particularly significant, exports expanded by 32.2 percent, accelerating from a 28 percent growth in May, and beating a forecast of 23 percent, though growth in imports slowed to 36.7 percent from May’s record 51 percent.

“China’s trade grew for 13 consecutive months and reached a record high during the same period,” Li Kuiwen, an official at the GAC, told a press briefing.

During the period, China also recorded high-speed growth with all major trading partners. Trade with the US rose 34.6 percent, with ASEAN 27.8 percent and the EU 26.7 percent. Despite trade tensions, China’s exports to the US rose 31.7 percent, while imports from the US jumped 43.9 percent. US agricultural imports surged 120.8 percent.

“Such a result is hard to achieve, considering all the pressures we faced – rising costs, the pandemic, and shifting global trade and economic recoveries,” Bai Ming, deputy director of the international market research institute at the Chinese Academy of International Trade and Economic Cooperation, told the Global Times on Tuesday.

In the past several months, skyrocketing prices of major raw materials, including iron ore and metals, exerted huge pressure on Chinese factories, prompting swift action from officials to stabilize prices. “The rise in international bulk commodity prices sporadically lifted up firms’ production costs,” Li said.

In the first half of the year, China’s iron ore imports increased 2.6 percent, while corn imports jumped 31.85 percent. Crude oil imports dropped by 3 percent.

The resurgence of COVID-19 cases in late May in South China’s Guangdong Province, a major manufacturing and export hub, had a great impact on manufacturing and shipping.

The challenges and results highlighted China’s resilience as the biggest trading country, adding that many trade partners still rely heavily on Chinese trade when they face serious COVID-19 outbreaks and when they embark on a recovery process, Bai said.

China’s trade with India, which was engulfed in one of the worst outbreaks of the COVID-19, surged 62.7 percent in the first half in dollar terms, the fastest growth in China’s trade with other countries during the period, official data showed.

China’s foreign trade in H1 2021. Graphic: Zhao Jun/GT

Warning signs

However, Bai also warned that “the real challenge” is in the second half of the year.

Li also warned that trade might slow down in the second half of the year.

“At the moment, the COVID-19 epidemic is still spreading in many places around the globe, the trend of the epidemic is complex and trade still faces many uncertain and unstable factors,” Li said.

Apart from the COVID-19 pandemic, other uncertainties include continuously rising commodity prices, the appreciation of the Chinese yuan, and rising external trade risks marked by the US’ push for an alliance to contain China’s rise, according to Sang Baichuan, director of the Institute of International Business at the University of International Business and Economics.

“It’s hard to say how much trade will slow in the second half of the year, but [growth] peaked in the first half of the year,” Sang told the Global Times on Tuesday.

Though many analysts say trade growth is hard to predict for the second half of the year given the uncertainties, overall trade will return to normal for the full year in the worst case scenario. Growth will mostly likely stay above 3.4 percent in 2019 before the pandemic, they said.

“As long as there is no major problem in epidemic control and prevention in the second half, there will be no big rollovers in foreign trade,” said Bai.

A cargo ship unloads imported potassium chloride at a port in Lianyungang, East China’s Jiangsu Province on Wednesday. As the spring ploughing period comes, fertilizer makers increased the volume of imported potassium chloride to ensure production. Photo: IC

‘Safe landing’

Still, slower growth could have a serious impact on certain sectors and businesses, as well as overall GDP growth, analysts noted.

After leading the global economic recovery from the COVID-19, China is widely expected to report a much slower growth for the second quarter, and even slower growth in the second half of the year.

GDP growth could slow to around 8 percent in the second quarter from a record 18.3 percent in the first quarter, and further drop to 5 percent in the second half of the year, according to several market forecasts.

Still, analysts argue that even the slowest pace in GDP growth in 2021 would be higher than pre-pandemic levels and the slowdown is a “safe landing” from unsustainably high growth. In its latest forecast released on June 29, the World Bank predicted that China’s economic growth could reach 8.5 percent for 2021, which would still be higher than the 6.1 percent growth in 2019.

The official warning of slower growth on Tuesday “was to make clear our confidence but also a reminder that we can’t take [the risks] lightly,” Bai said.

Chinese officials are not taking chances. In the past few days, they announced a slew of measures to help stabilize economic recovery, including an unexpected move by the central bank to cut the required reserve ratio, or RRR, for commercial banks starting Thursday to free up 1 trillion yuan in liquidity, and a State Council policy document to boost foreign trade.

Indicating further support may be under way, the State Council on Tuesday called for efforts to address fundraising difficulties for SMEs and labor-intensive firms, and push for major projects with special government bonds.

With all the measures underway to lift vulnerable sectors and businesses, officials are also striking a confident note for the country’s trade and economic development for the year.

“For the full year, there is still hope of relatively faster trade growth,” Li said, adding that China’s economy remains in a stable and upward trend.

Cargo ships carrying containers pile up at the Ningbo Zhoushan Port in Ningbo, East China’s Zhejiang Province on Tuesday. The boom in container throughput for foreign trade comes as the country’s yuan-denominated exports jumped 30.1 percent year-on-year in the first five months, customs data showed Monday. Photo: cnsphoto