In the interview, the Indian official emphasized that India seeks to show “broader opening to foreign investment” over the years and that the curbs on Chinese investment are just a “slight” step back. This statement gained a lot of exposure in Davos, but should not be interpreted as a compliment to India. In a forum that advocates trade liberalization, it is indeed “eye-catching” to brand oneself as “open” for making political deals.

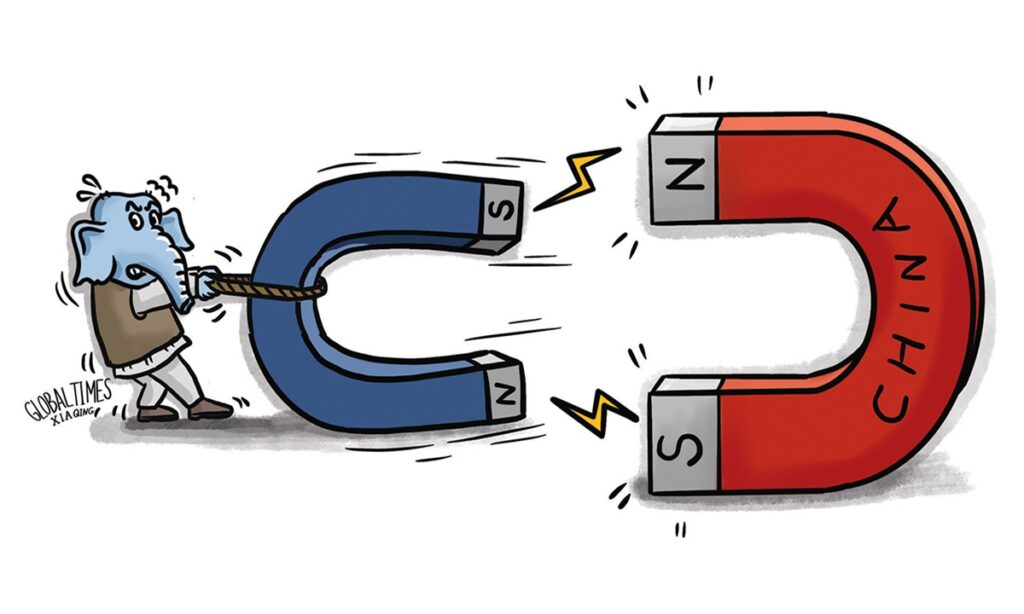

Over the past few years, India’s treatment of foreign enterprises and investment, especially those from China, have been in serious violation of market principles and rules, which further confirms and solidifies the outside world’s impression that India is a “graveyard for foreign investment.” India has created a variety of restrictions to suppress Chinese firms, and a considerable number of lawsuits have yet to be concluded. Many Chinese companies that have generally operated legally in India have also been slandered and smeared. Singh’s statement proves the speculation that India is actually selective in its law enforcement, and indirectly proves the innocence of Chinese companies.

This year, India dispatched a large-scale political and business delegation to Davos, and Indian lounges touting the Indian economy are said to have occupied a prominent position there. Including Singh, a number of senior Indian officials are trying hard to attract foreign investment to India. This comes against the background of India’s foreign direct investment in the first half of fiscal year 2023 to 2024 suffering a sharp dive. Indian government argued that this is due to a global slowdown, but Indian media bluntly pointed out that it is the poor business environment for foreign capital that has led to the retreat, with Chinese enterprises being a typical case. Singh’s statement may also be an attempt by India to rid itself of the image of “graveyard for foreign investment,” but his “goodwill” sounds weird and uncomfortable for other countries.

Economic globalization, trade liberalization and investment facilitation are irreversible trends, and there is no need to attach any other conditions to them. India using the opening-up of its economy as a bargaining chip to cash in on geopolitics is frankly a bit naive. Territorial sovereignty is the core interest of a country and cannot be traded. By weighing the concepts of “sovereignty” and “openness” in the balance of interests, India has devalued and vulgarized both concepts.

India has a massive population advantage, and in recent years, its economic growth rate has been decent. It is also making efforts to improve its industrial infrastructure. The outside world is optimistic about India, or more precisely the potential of India’s future, rather than its current reality. Even the voices from the US and Western countries, which tout India for geopolitical reasons, acknowledge its unfavorable business environment. If India cannot adjust its thinking and concentrate on development, the “filter” will break one day. Businesses are the most pragmatic of all. In fact, including Chinese enterprises, many multinationals have already been adjusting their operations in India.

In order for India to reverse this unfavorable trend and improve its business image, we can offer a suggestion: Pick yourself up where you fall. Since the larger negative impact has been caused by improper actions toward Chinese companies, it is necessary to regain the trust of Chinese enterprises by correcting these mistakes. As the spokesperson for the Chinese Ministry of Foreign Affairs mentioned, China hopes that India can fully recognize the win-win nature of China-India economic and trade cooperation, and provide a fair, just, transparent and nondiscriminatory business environment for Chinese companies investing and operating in India.

According to the statistics of the General Administration of Customs of China, bilateral trade between China and India reached $136.218 billion in 2023, building on the record high in 2022. Considering the persistent investment restrictions that India has imposed on China, this positive trajectory is noteworthy. It further underscores the intrinsic complementarity of the two economies and echoes calls within India for a “wiser” approach toward China. In recent times, there have been signals from top officials in India indicating a desire to ease tensions with China. We hope that this signifies India’s recognition of the broader situation and a response to public sentiment. “Openness” requires not only widespread publicity but also concrete actions, and what India needs most now is action.