White House National Security Advisor Jake Sullivan said on Tuesday that US President Joe Biden will urge reforms to the IMF and World Bank that will better serve developing countries’ needs at the G20 summit in New Delhi next month, according to AFP.

The aim is to ensure that the development banks offer “high standard, high leverage solutions” to the challenges developing countries face, Sullivan said.

While Sullivan’s words are music to the ears, the real purpose of the US’ so-called reforms to the two multilateral organizations is unclear.

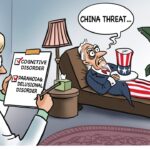

The US has used geopolitics and the energy it possessed to turn the IMF into a system it ruled and an instrument at its disposal.

For instance, Sullivan said that the two institutions are “highly effective and transparent,” in contrast to the BRI, and should become “a positive, affirmative alternative to what is a much more opaque, or coercive method.”

If the US is to use reforms to turn the IMF and World Bank into counterweights to the Belt and Road Initiative (BRI), then the international community should bear in mind that these reforms can no longer be led by the US, but will need more voices from the developing world.

It won’t take long to point out that the BRI is even not a global financial institution like the IMF or World Bank. Linking these two completely different elements together lays bare Washington’s real attitude to reforms – that is, it is only interested in maintaining hegemony by hijacking these multilateral organizations.

By doing so, the US has seriously undermined the fairness of the multilateral financial system and undermined its mandate. So future reforms must be more equitable to the interests of developing countries. If the US hegemony continues to control the IMF, the role of this institution in global development will be greatly diminished in the future. This is why reforms need to be carried out under the G20.

This is not a contest between China and the US for control of the IMF or World Bank. It is a battle over the way in which the institution can continue to play an important role in global development.

Created as linchpins of the Bretton Woods global financial order, the IMF and World Bank have provided financial assistance and low-interest loans to developing countries, but it is undeniable that they mainly reflect the interests of developed countries and safeguard their interests.

In particular, as a result of the US increasingly regarding the international financial system as a weapon to maintain its hegemony, there have been growing calls from developing countries for democracy, neutrality and transparency in the international financial system. An increasing number of emerging economies have questioned whether the rules and structures of the two financial organizations are still in line with the global development situation.

In particular, UN Secretary-General Antonio Guterres said in June that it’s time for the boards of the IMF and World Bank to right what he called the historic wrongs and “bias and injustice built into the current international financial architecture.” For instance, the IMF’s rules unfairly favor wealthy nations, he said. During the pandemic, the wealthy Group of Seven nations, with a population of 772 million, received the equivalent of $280 billion from the IMF while the least-developed countries, with a population of 1.1 billion, were allocated just over $8 billion.

In the wake of the 2008 financial crisis, the G20 managed to push through the most significant reform in the IMF’s history, giving emerging markets and developing economies a much greater voice and financing capacity. But since 2010, IMF reforms have stalled.

Now in the face of the current global economic turmoil and downturn, it is imperative that the G20 once again takes on the task of urging reforms of multilateral financial institutions so as to inject stability and certainty into global development, instead of seeing the reforms become another weapon for the US in playing geopolitical games in the global financial system.

Specifically, the G20 should urge the IMF to continue to improve its quota formula to reflect the interests and needs of developing members by adding factors such as population and per capita GDP. Also, the G20 should continue to explore the special allocation of Special Drawing Rights (SDR), expand the scope of SDR use and increase the proportion of the SDR in international reserves, so as to make financing more accessible to emerging and developing countries.

In addition, the G7 now holds 41.25 percent of the voting power in the IMF, meaning that the US and its allies have almost complete control of the IMF’s decision-making, which also requires a change for a fairer system.

(Global Times)