The US, Japan and South Korea on Friday jointly announced new measures on economic security, technology and other key issues, as the US side has intensified containment of China’s tech sector following the newly announced US investment restrictions. Chinese experts said that the reckless moves by the US and its allies are “doomed” and set to backfire, as China is pushing forward domestic replacements and tech self-reliance.

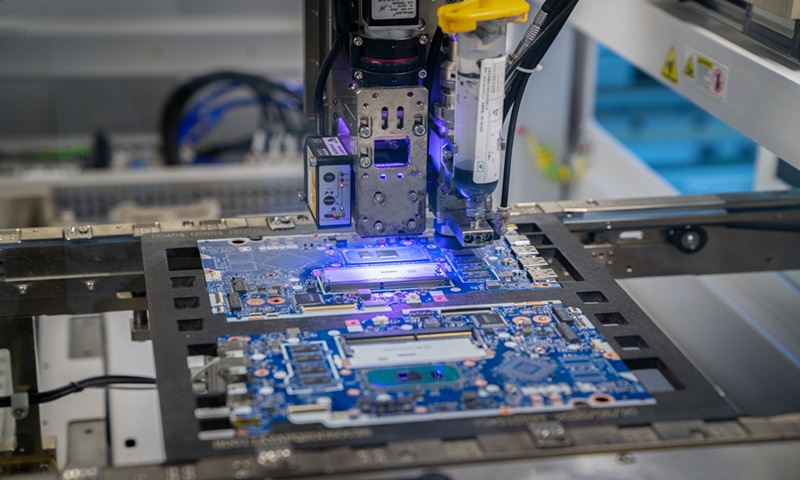

According to a joint statement on the White House’s website, the US, Japan and South Korea will strengthen cooperation in sectors including semiconductors and batteries, as well as on technology security and standards, artificial intelligence and quantum computing.

It said the three will work closely together to launch an “early warning” system to “enhance policy coordination on possible disruptions to global supply chains” as well as to better prepare to “confront and overcome economic coercion.”

They will enhance cooperation on technology protection measures to “prevent the cutting-edge technologies we develop from being illegally exported or stolen abroad,” read the statement.

Xiang Ligang, director-general of the Beijing-based Information Consumption Alliance, told the Global Times that the US moves to block China’s tech rise and economic development are doomed, as the US and its allies have already felt the pain from China’s increasing domestic replacements of technology products such as semiconductors.

For example, first-half sales of domestically made semiconductor equipment rose 35-40 percent year-on-year in China. The increased local supply pushed down memory chip prices, for example, chips with one-terabyte capacity sell for about 200 yuan ($28), compared with 1,300-1,500 yuan previously, Xiang said.

The Biden administration’s crackdown on China in terms of semiconductors has inflicted harm on US companies and caused collateral damage for Japan and South Korea. “Industrial cooperation between China and South Korea has been seriously disrupted by the reckless US moves, resulting in a slump in South Korea’s overall exports, including chips,” Ma Jihua, a Beijing-based senior industry analyst, told the Global Times on Sunday.

“The US has been pressuring its allies for years to exclude China from the global semiconductor industry chain, but only Japan and the Netherlands have joined its scheme, while South Korea still in hesitation, indicating that the US faces difficulties in pushing any ‘tech decoupling’ from China,” Ma said, noting that South Korea can’t do much to contain China even if it sides with the US.

Losing access to the massive Chinese market will make Japan face a Waterloo, experts said, referring to the rapid decline of Japan’s semiconductor industry.

China was the largest single semiconductor market in 2022, with sales of $180.4 billion, according to the Semiconductor Industry Association.

Despite the US government’s push for a tech decoupling, US chip conglomerate Intel recently built a new innovation center in Shenzhen, the manufacturing and technology hub in South China’s Guangdong Province, as the company expands cooperation with Chinese partners and taps into the potential of the vast Chinese market.

US chipmakers ramped up sales of modified chips to China. Nvidia has received orders worth $1 billion from Baidu, ByteDance, Tencent and Alibaba for approximately 100,000 A800 processors, as reported by the Financial Times, citing sources familiar with the matter.

(Global Times)