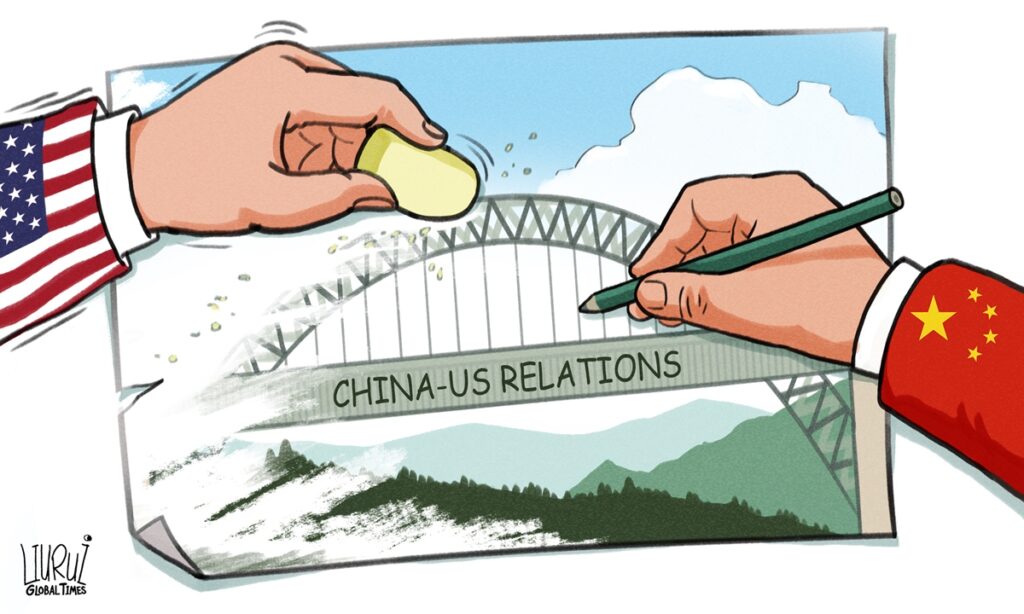

China on Thursday scathingly criticized the US government’s move to ban new US investment in key technology industries in China, the latest attempt in Washington’s relentless crackdown campaign against China. China has lodged stern representations with the US side and vowed to take necessary measures to safeguard its interests.

While US officials cited the so-called national security reasons for the executive order and maintained that the US does not seek to “decouple” from China, Chinese officials and experts said the latest US move is part of the US’ ill-intentioned campaign to contain China’s technological rise, which amounts to “economic coercion” and violates basic market principles.

The exact impact of the US ban remains to be seen, but Chinese tech industry insiders and analysts dismissed any so-called chilling effect hyped by foreign media, noting that the move has long been publicized by US officials and that US investments in the Chinese technology industry have already declined amid years of the US tech crackdown. Most importantly, the move, or other arbitrary restrictions, by the US will not derail China’s pursuit of technological self-reliance and strength, analysts said.

‘Economic coercion’

After weeks of media hype and speculation, US President Joe Biden on Wednesday US time signed an executive order to ban new US investments in key technology industries in China that could be used to bolster its military capabilities. The order will ban US venture capital and private equity firms from investing in Chinese projects in semiconductors and other microelectronics, quantum computers and certain artificial intelligence applications.

In a statement, the US Treasury Department insisted the move is a “narrowly targeted action” to “defend America’s national security,” and that the US maintains its “longstanding commitment to open investment.”

The US move immediately drew stern responses from Chinese authorities on Thursday. “Restricting US companies’ investments in China with national security as a front is a clear act of overstretching the concept of security and politicizing business engagement. The move’s real aim is to deprive China of its right to develop and selfishly pursue US supremacy at the expense of others. This is blatant economic coercion and tech bullying,” a spokesperson for the Chinese Foreign Ministry said in a statement on Thursday.

“President Biden has committed to not seeking to ‘decouple’ from China or halt China’s economic development. We urge the US to follow through on that commitment, stop?politicizing, instrumentalizing and weaponizing tech and trade issues, immediately cancel the wrong decisions, remove the restrictions on investments in China and create an enabling environment for China-US business cooperation,” the spokesperson said, adding that China has made serious démarche to the US and will resolutely safeguard its rights and interests.

In a separate statement on Thursday, the Chinese Ministry of Commerce blasted the US for seeking “decoupling” of bilateral investment under the guise of “de-risking,” which seriously violates the principles of market economics and fair competition that the US has always proclaimed. “China is seriously concerned about this and reserves the right to take measures,” the ministry said.

Analysts said the move once again lays bare the US’ hypocrisy and lack of credibility, as the US repeatedly engages in “economic coercion,” while accusing others of “economic coercion,” and is seeking to “decouple” from and contain China while top US officials have publicly stated otherwise. The move shows the US is getting desperate, as it comes at the expense of its own companies after years of endless crackdown measures have failed to contain China, analysts noted.

“The US is still moving forward on the track of containing China’s development, and it does not even hesitate to use administrative orders to block economic and trade exchanges. The US has been doing it for many years, so the new move carries no extra significance or chilling effect,” Gao Lingyun, an expert at the Chinese Academy of Social Sciences in Beijing, told the Global Times on Thursday.

Broad implications

While foreign media have hyped the seriousness of the move amid the most fraught moment in bilateral relations in decades, Chinese technology industry insiders mostly shrugged off any potentially grave or direct impact.

“Regarding the impact of the US restriction order, I think the market will not react very much. For one thing, the move has been advertised for a long time, news of which has basically been digested. Moreover, the business community has no illusions about the US government. Under the US’ technology war against China, US direct investment in Chinese high-tech fields has been declining,” an executive at a Chinese tech firm told the Global Times on Thursday.

The executive, who spoke on condition of anonymity, noted that while Chinese companies may face challenges in terms of technological innovation, which requires international cooperation, US companies will also be affected, as such restrictions will hurt their competitiveness.

The executive order is aimed at banning new investment, but US investment in the Chinese tech sector has already plunged due to other restrictive measures taken by the US. In 2022, total US-based venture-capital investment in China fell sharply to $9.7 billion from $32.9 billion in 2021, according to Reuters. So far this year, total venture-capital investment has reached only $1.2 billion.

Essentially, the ban is against US companies, and it is very unfair for those that hold intellectual property rights and technological advances in the affected areas, said Zhou Mi, a senior research fellow with the Chinese Academy of International Trade and Economic Cooperation.

“It [the ban] deprives US companies of the right granted by the US Constitution to reasonably choose how their funds and properties are used. From this perspective, this is very unusual,” Zhou told the Global Times on Thursday. He said that through the move, the Biden administration is not only violating international market principles, but also abusing its own executive power.

The move, which is scheduled to take effect next year, has already put Chinese and US businesses further into great uncertainty, as details about specific regulations and requirements remain sketchy. Reuters reported that the US government is expected to exempt some deals. There are more than 70,000 US companies that are currently doing business in China.

“It should be noted that in the short term, administrative orders will indeed hinder the flow of funds into some Chinese companies and into China, but the ban cannot stop the nature of funds seeking to profit,” Gao said, noting that US companies will always find ways around the curbs to invest in profitable projects.

Beyond the direct impact on investment, the move also brings more complications to the already extremely complex China-US relations, in which US officials continue to take toxic actions against China while also seeking to reach out to Chinese officials for dialogues. Following China visits by US Secretary of State Antony Blinken and US Treasury Secretary Janet Yellen, US Commerce Secretary Gina Raimondo is also widely reported to be visiting China soon.

While Raimondo’s visit has not been officially confirmed, the investment ban could complicate such official exchanges, analysts said. “No matter who comes, the basis for talks should be mutual trust. So it is hard to imagine that one can continue to push the other party to make corresponding adjustments, while simultaneously engaging in suppression and restrictions on that party,” Zhou said.

(Global Times)