It seems that the US push for “decoupling” from China has not only affected the bilateral trade relationship but has also contributed to a divergence in the inflation levels of the two countries. While it is still hard to tell what outcome the divergence between the world’s two largest economies will lead to, one thing is certain that the competition of the resilience and endurance of the two economies has just begun and it may take a very long time. China has ample policy tools to maintain its economic stability despite the US “decoupling” push.

China’s consumer price index (CPI), a main gauge of inflation, edged down 0.3 percent on a yearly basis in July, falling for the first time in more than two years, the National Bureau of Statistics said on Wednesday.

On the other side of the Pacific, the US CPI report on Thursday showed that inflation rose 3.2 percent annually in July, according to Dow Jones.

These days, there has been no shortage of Western media reports worrying about either the deflation risk facing the Chinese economy or that US inflation may continue to drive up interest rates, which are already at the highest level in 22 years after the latest hike by the US Federal Reserve. But strangely, they never mentioned how unusual it is to see such a consumer price divergence that has formed over time between the world’s two largest economies, which could bring the global economy to uncharted waters.

Some thought one or two years ago that the divergence was due to the two countries’ different monetary policy choices, but as time goes by, there are growing signs that the increasing “decoupling” of the two economies may be the real cause of the inflation divergence.

In the era of globalization, there was a time when the Chinese and US economies were closely intertwined. China, responsible for production, became the largest supply chain, while the US, responsible for consumption, became the largest market. The two economies have complementary interests in economic and trade cooperation. It is the highly complementary economic structure that has been supporting the continuous development of the Chinese and US economies.

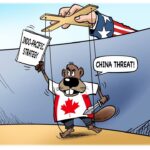

But things changed after the US started promoting the “decoupling” push, and the complementary relationship has been sabotaged as some in Washington believe China’s role in the US supply chain is replaceable and make policies based on the assumption.

Yet, the impact of “decoupling” on both economies is complicated and full of variables. So far, the only thing for sure is that both economies are facing challenges that were uncommon in the past decades.

China needs to find enough markets for its massive production capacity, while the US needs to restructure its supply chain to rein in inflation, debt and interest payments. With no return to the original track, both countries will undergo a long-term structural adjustment amid the “decoupling” process, which will be a test for their economic resilience and endurance.

For China, the economic “decoupling,” which is starting to have an impact on everything from exports and inflation to US investment in China, is almost certain to be a severe test for its economy in the coming decades.

But that doesn’t mean China’s future economic development is completely without advantages. To be sure, China still has sufficient tools to maintain its economic stability, such as consumption, investment, and reconnection with the global economy.

For instance, even after the US “decoupling” push, China’s huge middle-class has already formed a colossal consumer market, which, despite some temporary problems, can still support China’s economic growth in the long run.

The Chinese government is working out policies to stimulate domestic demand so as to enhance the role of domestic consumption in economic growth, offsetting impact of external shocks.

Moreover, factors such as enhanced innovation capability, industrial upgrading and transformation, regional cooperation and support for multilateralism will all help China maintain steady growth.

(Global Times)