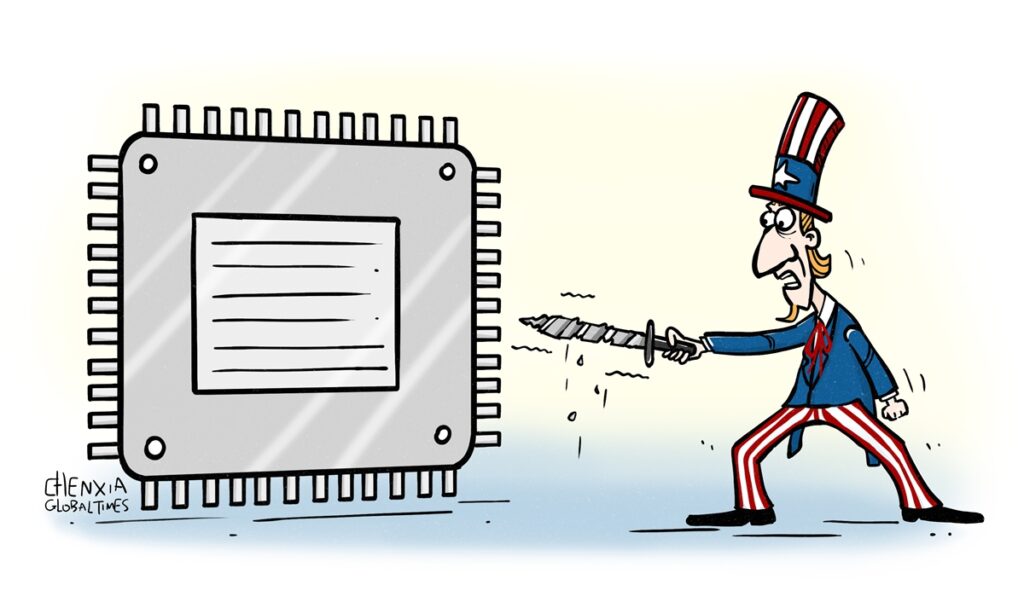

After the US restricted chip sales to China, the global semiconductor sector changed in unforeseen ways that are increasingly beyond Washington’s control.

Among these changes, China’s rising production capacity for low-end chips has become a new concern for those who want to limit China’s high-tech development, as long as it’s not at the expense of their market share.

China’s investment in the production expansion of legacy chips has drawn expressions of concern in the US and Europe over the potential dumping of Chinese chips in overseas markets, the Chinese version of Voice of America (VOA) reported on Wednesday.

During a recent panel discussion at the American Enterprise Institute, US Commerce Secretary Gina Raimondo warned that “The amount of money that China is pouring into subsidizing what will be an excess capacity of mature chips and legacy chips – that’s a problem that we need to be thinking about and working with our allies to get ahead of.” It is a typical hegemony not to sell China high-end chips while not allowing China to produce more low-and medium-end chips.

It has been a while since China began to invest heavily in chip self-sufficiency in response to US restrictions on China’s access to advanced chip production technologies. When formulating the policy on chip restrictions, US politicians may sincerely have believed that they would cripple China’s ability to pursue high-tech development, so as to make the Chinese market increasingly dependent on US chips.

Yet, as time goes by, the emergence of concerns over China’s “chip flood” may be a paradigm of Western anxiety and uncertainties about the uncontrollable consequences of the chip ban. China’s pursuit of chip self-sufficiency has put a damper on Washington’s calculation.

Moreover, during the imposition of chip bans, US chipmakers have been affected just as much as Chinese companies. Major international chipmakers reported losses in the first quarter of 2023, and the losses continued in the second quarter for most chipmakers.

The losses were mainly attributed to weak demand due to a global economic slowdown and sweeping US chip export curbs on China, the world’s largest semiconductor market. These self-inflicted losses are imposing growing pressure on the Biden administration.

What’s more important is that the rising chip production capacity in China has made the Chinese market less dependent on US chip supplies, contrary to US’ expectation.

In the first four months of this year, the number of Chinese-made chips increased by 39.2 billion, while China’s chip imports fell by $36.3 billion, according to Chinese media reports.

Given China’s production capacity of legacy chips like 28-nanometer versions and its investment to expand production, China is apparently getting closer to its goal of chip self-sufficiency. Currently, 28-nm versions are the most widely used chips in manufacturing applications.

China’s chip manufacturing technology has also advanced rapidly amid the US sanctions, offering technical support for future mass production. For instance, China will launch its first 28-nm domestic lithography machine at year-end, representing a great leapfrog for the nation’s chip industry, the Securities Daily reported recently.

The increase in China’s legacy chip production will restructure the domestic chip market and also increase China’s share in the chip supply chain for global manufacturing. When it comes to legacy chips that are in great demand in the global manufacturing industry, the chances are that China’s strength in mass manufacturing and price advantage will stand out.

That being said, even if the US and its allies want to promote “decoupling” from China through the chip ban and other measures, with China’s rise in legacy chip production, China’s connections with the global manufacturing industry will only deepen.

(Global Times)