The IMF said on Tuesday that China’s underperforming recovery is dragging down the global economic recovery, despite keeping its forecast for China’s GDP growth unchanged.

While the IMF maintained its forecast of 5.2 percent economic growth for China this year, it still mentioned in its latest World Economic Outlook that “China’s recovery could slow, in part as a result of unresolved real estate problems, with negative cross-border spillovers … Sovereign debt distress could spread to a wider group of economies.”

If anything, the IMF forecast for China mirrors concerns over the challenges facing the country’s economy. It’s just such concerns that show the importance of the Chinese economy and its contribution to global growth.

China is projected to contribute 34.9 percent to global economic growth in 2023, the IMF said in a report in May.

The rise of China’s contribution from less than 10 percent two decades ago to the current one-third of global economic growth is indicative of China’s achievements and its success in adhering to the right path for social and economic development.

China has the ability to address the challenges and problems it has encountered. Even amid the difficult and complicated external environment, it’s important to maintain confidence in China’s ability to tackle challenges.

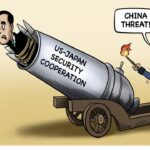

In addition to domestic factors, China’s economic challenges come mostly from the severe external environment. For a long time, the US and some Western countries have pursued a so-called “decoupling” from China with an aim to suppress China’s industrial chain, under the guise of “de-risking” their own supply chains.

By doing so, they are actually creating risks and laying a trap for their own economies, which is why, ironically, there is open concern in the market about the potential risks from China’s slower economic recovery.

Given China’s importance to the world economy, isn’t it obvious that some of the containment measures they have taken could put China’s economic development in jeopardy? Then, what will happen to their own economies?

If nobody wants to see the worst-case scenario, everyone should strive to get through economic difficulties together, not create extra problems and risks for the global economy.

China will shoulder its responsibility in ensuring growth, which is crucial not only for its own development but also its interactions with the world economy.

There is no denying that 2023 will be a test for China, given the global economic sluggishness, and it is justified to have some concerns about the Chinese economy. But we are already aware of what challenges await the Chinese economy in the near future, and the relevant authorities are actively looking for solutions.

For instance, the meeting of the Political Bureau of the Communist Party of China Central Committee pointed out on Monday that the economic situation faces new challenges due to insufficient domestic demand, difficulties for some enterprises, risks in crucial sectors and a complex external environment.

Also, on Monday, the National Development and Reform Commission, the top economic planner, issued a notice saying it would further build up relevant mechanisms and improve the policy environment to spur the development of private investment, amid the nation’s all-round efforts to spur the private economy.

Apparently, despite the challenges, policymakers still have many measures at their disposal to address risks and ensure steady momentum for global economic growth.

The crux now lies in the implementation of these economic stimulus and support policies by the authorities at all levels, so as to ensure they can really make a difference in reviving China’s economic vitality and economic confidence.

After all, the global economic recovery relies on the joint efforts in better dealing with challenges ahead.

(Global Times)