As the first half of 2023 is coming to an end, global expectations for the Chinese economic recovery in the second half remain robust as China’s continuous efforts to expand its services sector access for foreign companies in a comprehensive and orderly manner and to shorten the negative list of foreign investment access inject new momentum.

It is true that various Western media outlets have been playing up the gloomy outlook for the Chinese economy, claiming that China’s economic recovery is running out of steam, as growth appears to be slowing in terms of a slew of economic indicators such as exports and factory production. Some even claimed that China is caught in a “confidence trap.” Is this really so? The truth is that if the Chinese economy is really as gloomy as they say, then why have foreign executives been coming to China so intensively?

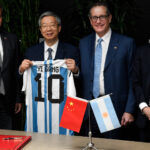

High-profile names of CEOs and senior executives who have recently visited China include Microsoft’s co-founder Bill Gates, Tesla CEO Elon Musk, Apple CEO Tim Cook, Qualcomm CEO Cristiano Amon, ASML’s CEO Peter Wennink, and JPMorgan Chase & Co’s CEO Jamie Dimon.

Moreover, the 14th Annual Meeting of the New Champions, also known as the Summer Davos Forum, which was held from June 27 to 29 in Tianjin, attracted more than 1,500 political, business, and academic elites from nearly 100 countries and regions. Confidence, openness and cooperation are the key words for the participants when it comes to discussions about China’s economic prospects.

There is no denying that due to the complicated and grim external environment and sluggish global trade and investment, the foundation and conditions for China’s economic recovery may not be as solid and favorable as expected. But that doesn’t change China’s economic resilience.

When addressing the opening of the Summer Davos this week, Chinese Premier Li Qiang said that China is expected to achieve this year’s economic growth target of around 5 percent, with the growth in the second quarter to surpass that in the first quarter. His remarks, to a certain extent, indicate that China’s macro-policy emphasis is not on the stimulus of rapid growth, but on maintaining the sustainability of economic recovery to ensure the resilience amid the changeable environment. And such economic resilience may exactly be a major appeal to foreign businesses when the global economy is slowing.

For China, what is crucial right now is how China can translate foreign companies’ confidence into actual growth and further propel its upward trajectory. Further opening-up seems to be the only answer.

In the past, China’s adherence to reform and opening-up has achieved the miracle of long-term high-speed economic growth. If China’s economy is to achieve sustained growth in the future, it must still maintain its openness despite external “decoupling” or “de-risking” pressure.

Like China’s economic recovery, its opening-up is also a continuous and gradual process while various government authorities have successively rolled out their agenda and measures to promote opening-up.

Wang Shouwen, China’s International Trade Representative and Vice Minister of Commerce, recently said that China will continue to uphold a high-level opening-up for development. At present, China has basically opened the market access to manufacturing sector for foreign enterprises, and is expanding its services sector access.

The National Development and Reform Commission said in mid-June that China is studying measures to attract foreign investment and will reasonably reduce the negative list for foreign investment access. China’s “2022 Catalogue of Encouraged Industries for Foreign Investment” was officially implemented on January 1 this year. The 239 new items added marked a record high.

Indeed, news of expanded access for foreign investment can now be heard almost every few days. According to Chinese government information on Thursday, the State Council has recently issued a document about measures to promote systematic opening-up in pilot free trade zones and free trade ports. Among them, it specifies that apart from specific new financial services, if Chinese financial institutions are allowed to carry out a certain new financial service, then foreign financial institutions in pilot regions should also be allowed to carry out similar services.

Also, Chinese governments at all levels are strengthening communication with foreign investors to help them solve specific problems and constantly improve the environment for foreign investment.

Of course, there are both opportunities and challenges for China to attract foreign investment. Faced with the global industrial chain restructuring, China will continue to do a solid job of improving the country’s business environment for global businesses.

(Global Times)