India and Bangladesh have reached a deal that will see a part of their bilateral trade transactions settled in their own currencies, the Indian rupee and the Bangladeshi taka, several Russian and Indian media outlets reported over the weekend.

Specifically, $2 billion worth of Indian exports to Bangladesh, out of roughly $13.69 billion in the last fiscal year, will be traded in rupees, while the rest will be paid in US dollars. Meanwhile, Bangladeshi exports to India, which stood at about $2 billion in 2022, will be fully traded in rupees and takas, according to ANI.

Before Bangladesh, 18 nations, including Russia, Germany, the UK, Singapore, Sri Lanka, Malaysia, Oman, and New Zealand, had already started settling overseas trade with India in Indian rupees, the Hindustan Times reported.

The development points to the trend that India has accelerated its de-dollarization process in foreign trade, which, to a certain extent, highlights the pressure a strong dollar has put on the foreign exchange reserves of emerging countries like India.

Given its ambition to develop its domestic manufacturing sector, India has an objective need to import large amounts of energy products and other raw materials for production, which has led to a growing trade deficit over the years. In 2022, India’s trade deficit stood at about $270 billion, about 51 percent higher than $178 billion in 2021, according to Indian media reports.

Meanwhile, the tightening monetary policy of the US Federal Reserve has also placed great pressure on India’s dollar liquidity. Thus, it becomes increasingly unsustainable for India to settle its foreign trade completely in US dollars, and seeking diversification and increasing settlement in local currencies will help relieve the pressure on India’s dollar reserves and facilitate its trade other countries.

In 2022, India launched its own rupee trade settlement mechanism, a means allowing countries that don’t have enough dollars or cannot trade in dollars to trade in rupees. It means that de-dollarization is not just a matter of risk aversion, but also a manifestation of the growing weight of trade by developing countries, especially emerging economies, in global trade.

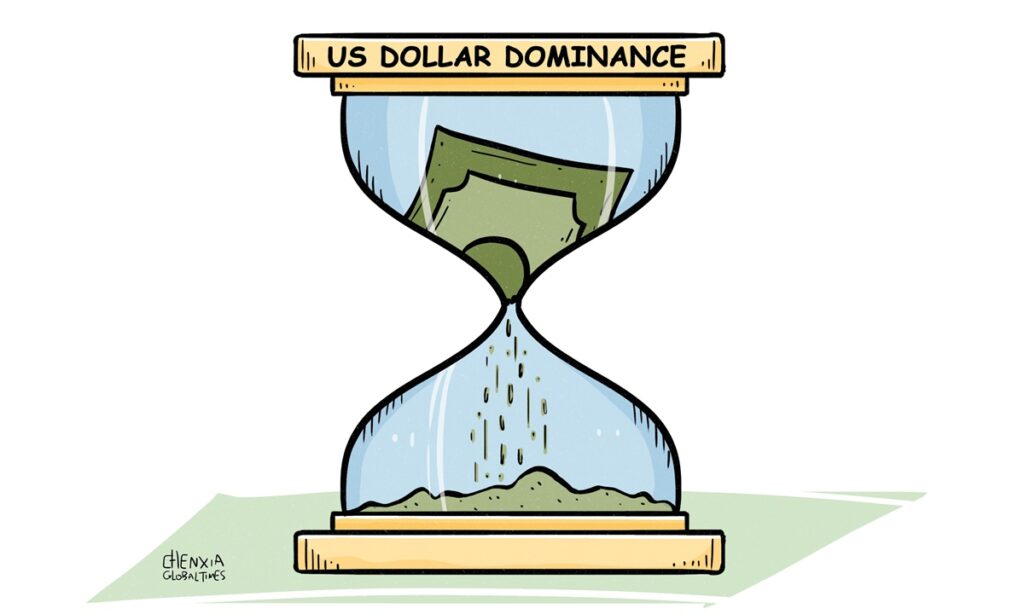

While Washington has been luring India into its containment campaign against China, India’s abandoning the US dollar in certain trade is significant. In fact, India’s move is just the tip of the iceberg when it comes to the global de-dollarization trend, as confidence in the dollar has been on the decline among economies. Given the fact that about a quarter of the world’s population is directly affected by US financial sanctions, it is actually not surprising to see the de-dollarization push by other countries. Whether to evade US sanctions or to avoid becoming the next target, the US’ abuse of its dollar hegemony has accelerated the loss of confidence in the dollar.

Currently, countries seeking to diversify their settlement currencies in international trade have spread across five continents, and so far this year, more countries than ever have taken specific moves in de-dollarization. At the end of March, China and Brazil reached a deal that will allow the two countries to carry out trade and financial transactions directly in the Chinese yuan or the Brazilian reais, instead of using the US dollar as an intermediary.

Almost at the same time, ASEAN announced the plan to help ASEAN economies gradually shift from using international currencies like the dollar to local currencies in financial transactions, so as to reduce dependence on international currencies.

In early April, India signed an agreement with Malaysia that allows the bilateral trade to be settled in Indian rupees.

While the growing awareness of de-dollarization is encouraging and the US’ dollar hegemony is indeed facing serious challenges in the long term, it is undeniable that de-dollarization is not something that can be achieved in the short term. In the foreseeable future, the dollar will remain the most frequently used currency in the world. Another issue for the de-dollarization process is that given the volatility in the currencies’ value of many countries, de-dollarization of emerging market economies may pose risks to financial markets. That requires more considerate arrangements and coordination among countries.

(Global Times)