Chinese mainland stocks mounted a remarkable rally on Monday, the first trading day of the year of the Rabbit, with a benchmark surging to a near bull market, despite a pullback later in the session, as market sentiments are evidently buoyed by a better-than-expected travel and spending spree during the Spring Festival holidays.

Further highlighting the growing optimism for a solid recovery in the world’s second-largest economy, overseas capital also continued to pour into the Chinese mainland stock market on Monday, with daily inflows hitting the highest level in over a year and monthly inflows on track for a fresh record.

The forecast-beating travel and consumption rebound as well as what officials call “stable and orderly” epidemic situation during the seven-day Chinese New Year holidays offered not only a resounding rebuttal for certain foreign media’s prediction of a “COVID catastrophe” during the holidays, but also more evidence that China’s anti-COVID response over the past three years was the most economical and effective, analysts noted.

Photo:VCG

Bullish sentiment

After a stream of positive news about the travel and spending spree during the Spring Festival holidays, Chinese mainland stock markets opened significantly higher on Monday morning, with the benchmark Shanghai Composite Index opening 1.35 percent higher. Though stocks pulled back later in the session, all the three main indexes made gains at market close, with the ChiNext Index, which tracks China’s Nasdaq-style board of growth enterprises, gaining 1.08 percent.

Moreover, despite losing steam in the afternoon, the CSI 300, which tracks the largest Chinese mainland-listed stocks, gained more than 20 percent from its recent low seen at the end of October 2022, indicating Chinese mainland stocks entered a technical bull market. The CSI 300 closed only 0.47 percent higher, but that still represents a 19.74-percent gain from its October low.

“The surge of consumption during the Spring Festival has exceeded many people’s expectations,” Yang Delong, chief economist at Shenzhen-based First Seafront Fund Management Co, told the Global Times on Monday. “As a barometer of the economy, the stock market tends to head for the bull market during an economic recovery phase.”

A growing number of signs from travel and consumption during the just-concluded Spring Festival holidays indicate that China has not only exited recent COVID-19 infection peaks in a stable and orderly manner but actually embarked on a rapid economic recovery.

On Monday, as hundreds of millions of Chinese people returned to work, China’s top public health authority, the National Health Commission, declared that anti-epidemic work during the holidays was stable and orderly, adding that the downgraded anti-COVID-19 measures were fully implemented and showed good results. “At present, the overall epidemic situation in the country has entered a low epidemic level, and the epidemic situation in various places has maintained a steady decline,” Mi Feng, a spokesperson for the commission, told a press briefing.

That is significant when considering the remarkable surge in travel during this year’s chunyun, the Spring Festival travel rush. As of Sunday, the country’s transport system carried 892 million passenger trips during the chunyun, up 56 percent from the same period last year, according to the Ministry of Transport on Monday.

Anticipating the surge in the number of travelers following the downgraded anti-COVID measures, some foreign media outlets made dire predictions about China’s epidemic situation during the holidays. An article published by Bloomberg before the holidays even predicted that a “COVID catastrophe” was looming. All signs so far have shown the opposite of a catastrophe.

Tourism and consumption also rebounded remarkably. During the holidays, a total of 308 million domestic trips were made, up 23.1 percent from 2022, according to official data. Meanwhile, China’s movie box office revenue hit 6.76 billion yuan during the holidays, the second-highest gross figures for this holiday to date, official data showed.

“The gains of the stock market on the first trading day of the year of the Rabbit is within expectation due to the holiday factor as well as the better-than-expected economic recovery,” Dong Shaopeng, a senior research fellow at the Chongyang Institute for Financial Studies at Renmin University of China, told the Global Times on Monday.

People shop at Haikou Riyue Plaza Duty Free Shop in Haikou, south China’s Hainan Province, Jan 25, 2023. Photo:Xinhua

Global confidence

Such better-than-expected recovery has also evidently boosted overseas investors’ confidence in the world’s second-largest economy this year, as most major economies, notably the US and Europe, are mired in a litany of economic woes.

On Monday, foreign capital continues its buying spree of Chinese shares for a 14th straight trading day, with the amount of “northbound capital” – foreign money flowing into China’s A-share market through Hong Kong – exceeding 18.6 billion yuan, the highest level since December 2021. Total inflows so far this month has reached nearly 131.8 billion yuan, on track for a new monthly record and higher than the total inflows of about 90 billion yuan in all of 2022.

“In other words, within two weeks of the beginning of this year, the amount of foreign capital inflow exceeded that of the whole of last year, which shows that foreign capital is still very optimistic about China’s high-quality assets,” Yang said, noting that China’s economic recovery following the adjusted measures has greatly boosted attractiveness among foreign investors given China’s 30-percent contribution to global growth.

In stark contrast to China’s rapid economic recovery this year, other major economies, especially the US and the euro area, are facing a risk of falling into a recession, which also threatens to drag down global growth. Such a contrast also further underscored the effectiveness of China’s anti-COVID measures over the past three years both in protecting public health as well as minimizing economic losses, analysts noted.

“In the past three years, the pandemic has had a great impact on the recovery and growth of the global economy. Even last year, major economies still had negative growth. Although the Chinese economy has also suffered a great impact, it still maintains positive growth, injected impetus into global growth, and is basically the main source of growth with a huge contribution,” Cong Yi, dean of the School of Marxism at the Tianjin University of Finance and Economics, told the Global Times on Monday.

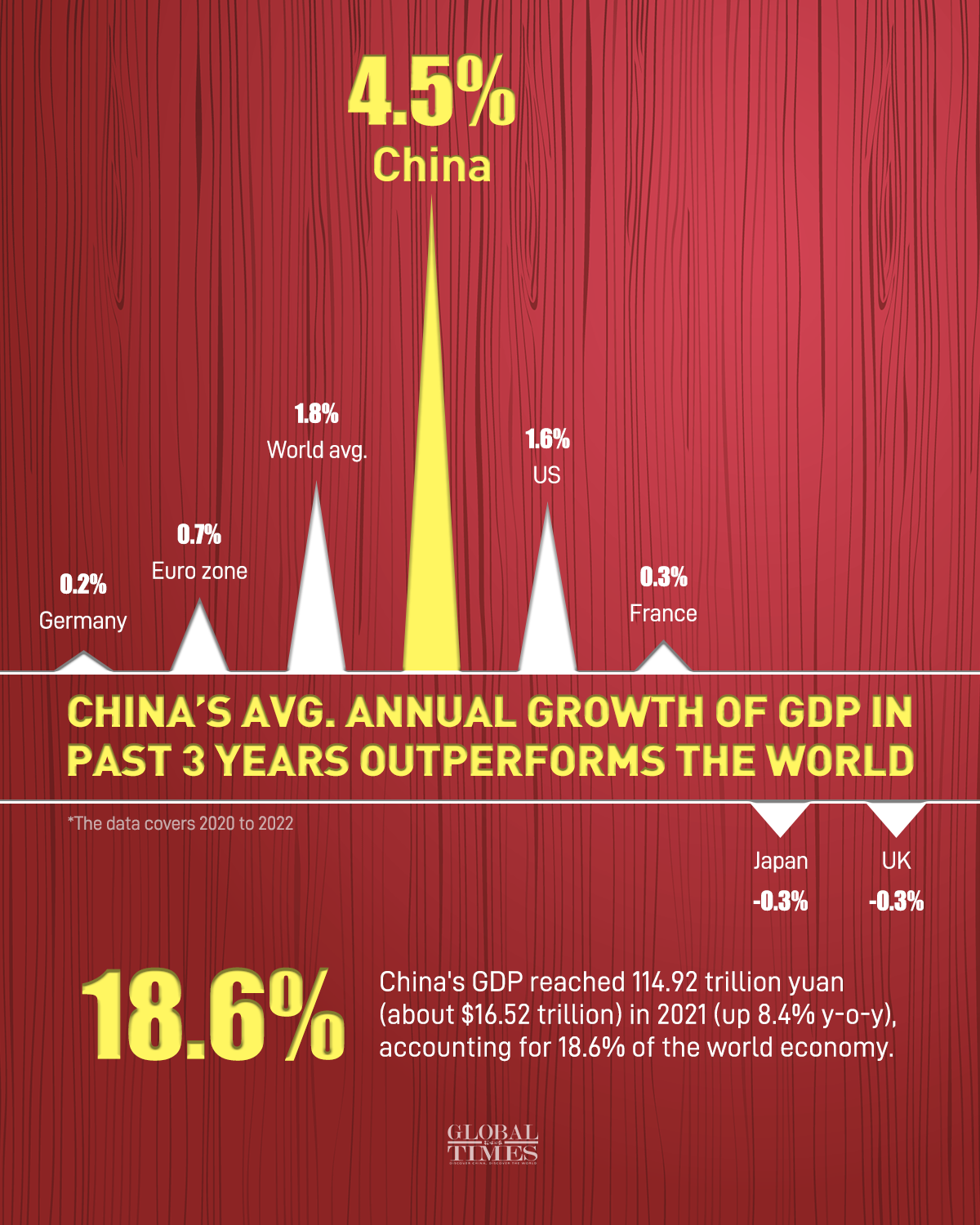

Graphic: Deng Zijun/GT

On average, China’s economy grew by 4.5 percent over the past three years under the cloud of the pandemic, significantly higher than the 1.8-percent global growth and the 1.6-percent growth in the US, which essentially gave up fighting the virus earlier on to focus on the economy and a 0.7-percent growth in the euro area. But that does not account for the sky-high inflation in many of these major economies over the past three years, which has caused cost-of-living crises in many places.

As China emerges from the haze of the COVID-19, the Chinese economy is expected to outperform other major economies in 2023. For instance, many economists expect China’s economy to grow above 5 percent this year, while the US economy is expected to grow by less than 1 percent if not falling into a recession.

“Although the real GDP of the United States is still growing at a relatively high level, we believe that the US economy will still face a high probability of entering a substantive recession, which may occur in the first half of this year,” Ming Ming, chief macroeconomist at CITIC Securities, told the Global Times on Monday, noting that the US economy is unlikely to see a “soft landing” this year.

In comparison, “China’s economy is a hard-to-find huge opportunity for the global economy, which is still on the rise,” Cong said.

(Global Times)