As the US mounts efforts to intensify its crackdown on China’s chip industry, China strongly fought back by filing a lawsuit with the WTO over the US’ discriminatory measures, a move experts said is a smart action to solve a bilateral dispute under a multilateral mechanism and pave the way for further counterattacks.

According to a Bloomberg report on Monday, Japan and the Netherlands have agreed in principle to join the US in tightening controls over the export of advanced chip making machinery to China.

Jake Sullivan, the White House national security adviser, also said that the US has spoken with countries including Japan and the Netherlands to tighten chip-related exports to China, a Reuters report noted.

This is the latest move of the US-initiated attacks against China’s semiconductor industry after the Biden administration unveiled export controls in October that ban Chinese companies from buying advanced chips and chip-making equipment without a license. The US also tried to form a chip alliance in partnership with several Asian economies.

According to a statement posted by China’s Ministry of Commerce (MOFCOM) on its official website, China has filed a lawsuit with the WTO over the US’ chip export control measures.

Chinese Foreign Ministry spokesperson Wang Wenbin said on Tuesday that the US’ abuse of export control measures to hinder the normal international trade of chips and other products will distort global semiconductor supply chains and disrupt international trade.

“All countries should step forward and Washington’s unilateralism and protectionism should no longer be allowed to go unchecked. This is not only related to the stability of the global trading system, but also concerns international morality,” Wang said.

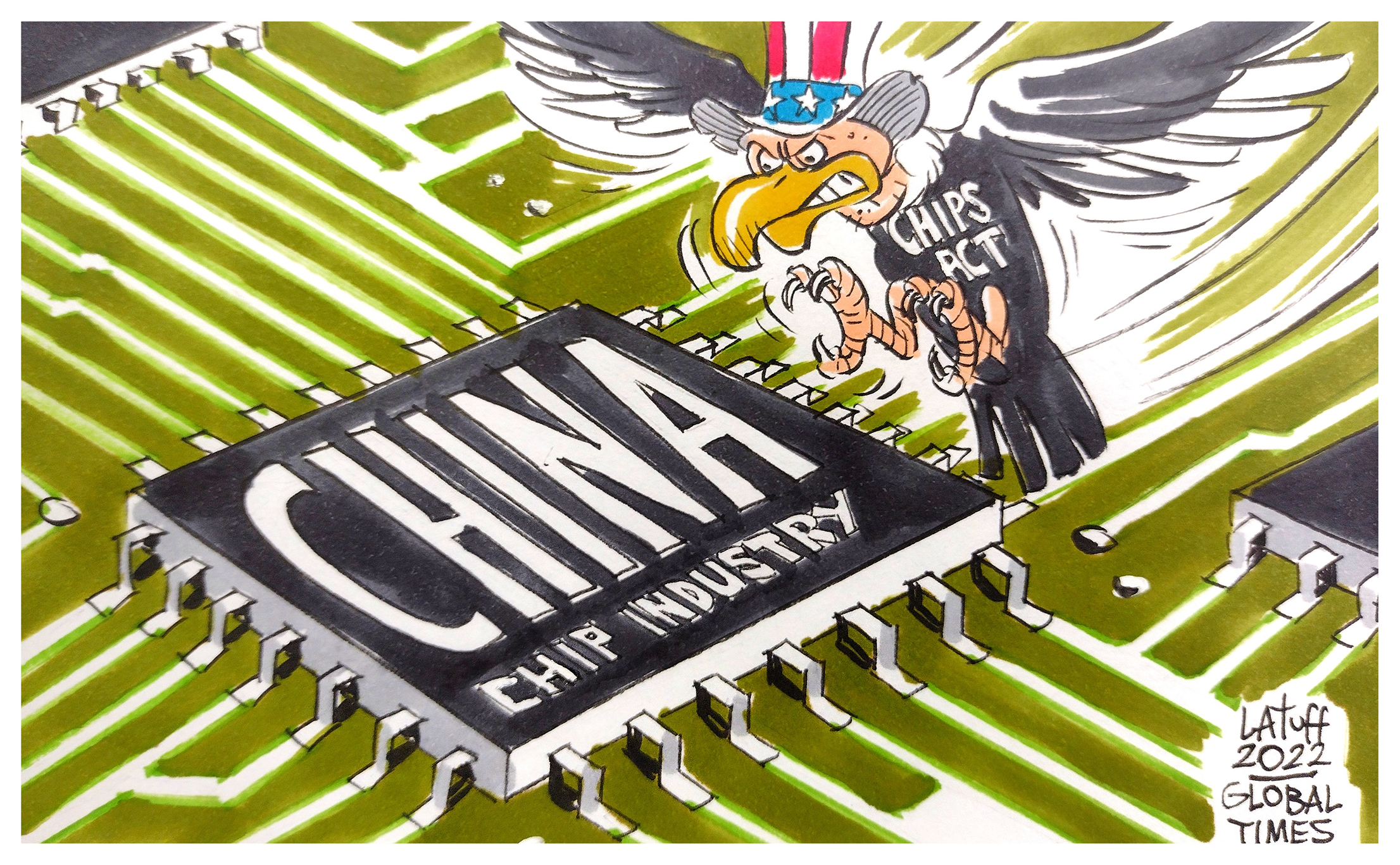

US claws at China’s chip industry fanning flames on tech confrontation. Cartoon: Carlos Latuff

Past failure

According to experts, the US’ persuasion of some of its allies to join its export controls toward China is the latest practice Washington adopted to cripple China’s semiconductor industry, after it has already launched two stages of attacks against China’s semiconductor sector.

One is imposing trade bans on Huawei to block the production of their flagship Kirin chipsets, and the second is establishing a chip alliance called Chip 4 with some Asian economies including Japan and South Korea to exclude China’s semiconductor supply chains, they noted.

“This is a signal that the US is mounting a comprehensive blockade against China in the semiconductor sector, possibly extending from advanced manufacturing equipment and American chip technology to certain mature processing equipment and Japanese technologies,” Zhang Xiaorong, director of the Beijing-based Cutting-Edge Technology Research Institute, told the Global Times.

It also looks like a last-ditch move after many crackdown tactics adopted by the US targeting China have not achieved the desired effects, whether in terms of trade or tech, experts said.

“The US’ escalation in the chip war against China comes after its trade war has not progressed well, and the US government is desperate to show to its people that its measures against China are having some tangible results,” independent tech analyst Ma Jihua told the Global Times.

As the Biden administration continues to increase chip export control measures, it is easy to see that the previous policies have not worked well, Ma said.

The US managed to hold a preliminary meeting on the Chip 4 alliance recently along with its allies, according to media reports, but news is coming out that officials from those “allies” are expressing doubts about following in the US’ footsteps to go against China.

South Korea should take a careful approach in deciding whether to join the Chip 4 alliance, the Korea Times cited an official as saying in July.

Split alliance

After meeting some difficulties in pulling in South Korea to decouple from China’s semiconductor supply chains, the US is again trying to win support from Japan and lately the Netherlands, one which China is quite reliant upon for advanced chip producing machines while the other is more obedient than South Korea to the US’ semiconductor-related orders.

Fu Liang, a veteran tech analyst, told the Global Times on Tuesday that Japan’s discourse power in the semiconductor industry is relatively weak as its technological progress has lagged behind other nations in recent years, while consumption demands are also down.

“It lacks advantages of some companies such as Samsung whose competitiveness is strong and does not rely on external partners that much,” Ma said, adding that Japan can’t afford to offend such a big partner as the US.

However, experts stressed that Japan and the Netherlands will not accept all the US’ requirements, as they have their own interests to care about.

Ma noted that in the case of the Netherlands, it may restrict exports of advanced products, but not mature ones because if it does not export, it will lose the large Chinese market.

According to the 2021 financial statement of the Netherlands-based ASML, a leading global supplier of semiconductor production machines, the Chinese market was its third-largest, accounting for a 14.7 percent share of its global revenue last year.

On the other hand, Japan also exports semiconductor products to China, while importing semiconductor materials from China. So a complete decoupling means economic losses for the country, Ma noted.

Besides, experts said that the US’ pressure on Taiwan Semiconductor Manufacturing Company to build a factory on US soil also sets a bad example for other countries, making them worry about loss of talent and advantages in the global chip supply chain, Ma said.

“The US is ambitious to build an independent and complete chip industry chain that is decoupled from China and is completely under its own control. This will also mean the Netherlands and Japan have less say in global chip industrial chains, something which those two countries and South Korea are concerned about,” Ma said.

China’s countermeasures

Experts also noted that China’s countermeasures in the face of the US crackdown in the high-tech sector have grown increasingly mature over the years, evolving from just making concessions like Chinese telecommunications giant ZTE did to taking varied countermeasures, including resorting to international organizations and pushing domestic research of advanced chip technologies.

According to the MOFCOM statement, filing a lawsuit with the WTO is a way of seeking to address Chinese concerns through legal means, and a necessary way to defend China’s legitimate interests, the ministry said.

“In recent years, the US has been generalizing the concept of national security and abusing export control measures, which hinders the normal international trade in chips and other products, as well as threatening the stability of the global industrial chain and supply chain,” the MOFCOM statement said.

The ministry urged the US to give up its zero-sum game mindset, correct its wrongdoings in a timely manner, and stop disrupting trade in high-tech products such as chips, so as to maintain normal economic and trade exchanges between China and the US, and maintain the stability of the global supply chain.

China’s legal action against the US in the WTO over chip export control measures shows that it hopes to solve the bilateral dispute under a multilateral mechanism, making China’s next counterattack more plausible, Ma said.

“Once China starts fighting back, it won’t be just one policy, ” he said, expecting that more countermeasures will be announced in the near future.

Chen Jia, an independent research fellow on international strategy, also commented that the world needs China’s wisdom and contribution in terms of globalization and a new scientific and technical revolution, something which has been probed repeatedly during the past 40 years’ of China’s high-quality development.

“The US might achieve industrial decoupling with China in certain regions and in a short period of time, but it cannot endure, whether for itself or for its so-called allies,” he said.

(Global Times)