Chinese digital forensics company Meiya Pico claimed on Tuesday that it has made stable and reliable electronic data forensics equipment and domestic alternatives to big data platforms, achieving a major technological breakthrough two years after being put on the US Entity List in October 2019.

The company, based in China’s coastal province of Fujian, said that after being put on the US Entity List, it immediately launched an “ice-breaking plan” and an “ice-breaking laboratory” was established to underdo vigorous tech innovation.

Now, it has achieved breakthroughs to resolve key “stranglehold” problems, it said on an investor interactive platform on Tuesday.

Established in 1999, Meya Pico is a leader in domestic electronic data forensics sector, and is expanding from traditional network security to sectors like industry and commerce, taxation, customs, municipal supervision, and emergency response, according to the company’s introduction.

The low-profile company gained fame after being blacklisted by the US in October 2019. Companies added to the so-called Entity List since then include facial recognition start-ups Sensetime, Megvii and Yitu, video surveillance specialists Hikvision and Dahua Technology, and AI leader iFlyTek, and Yixin Science and Technology Co.

Analysts said Meiya’s statement showed the latest efforts by Chinese companies to counter the US coercion in high-tech innovations.

The breakthrough may be linked to software upgrading, on which China still relies on imports, Zhang Xiaorong, director of the Beijing-based Cutting-Edge Technology Research Institute, told the Global Times on Tuesday, while notin in the digital forensics industry, Chinese companies are now on the same level as other global counterparts.

According to its website, Meiya Pico is one of the two listed companies in the global electronic data forensics industry, and it does business not only in China, but also in countries and regions along the China-proposed Belt and Road Initiative.

Nevertheless, observers said the digital forensics industry may represent only a small portion of the increasingly intense China-US competition in the high-tech sector. A more burning issue remains the gap in cutting-edge semiconductor manufacturing that China may need many years to overcome.

“China has the ability to make low-end chips, and it has achieved breakthroughs in some key areas along the industry chain in recent years, but it lags behind in some key areas,” veteran telecom analyst Fu Liang told the Global Times on Tuesday.

Fu said the semiconductor industry chain is not a matter of competition between China and the US, but a much more complicated one that no country can achieve on its own.

China may depend on the US for some technologies, while for US firms, there’s no doubt “China is a market that American firms need when developing cutting-edge technology,” said the analyst.

In 2021, China remained the largest semiconductor market, with sales of $192.5 billion, up 27.1 percent, according to data from the Semiconductor Industry Association.

Global chip sales hit a record $555.9 billion in 2021, up 26.2 percent from the previous year. The association expects global chip sales to grow 8.8 percent in 2022 as chipmakers continue to expand capacity to meet demand.

The burgeoning demand will last for years, driven by Chinese firms’ rapid development in 5G and other information industries, Fu noted.

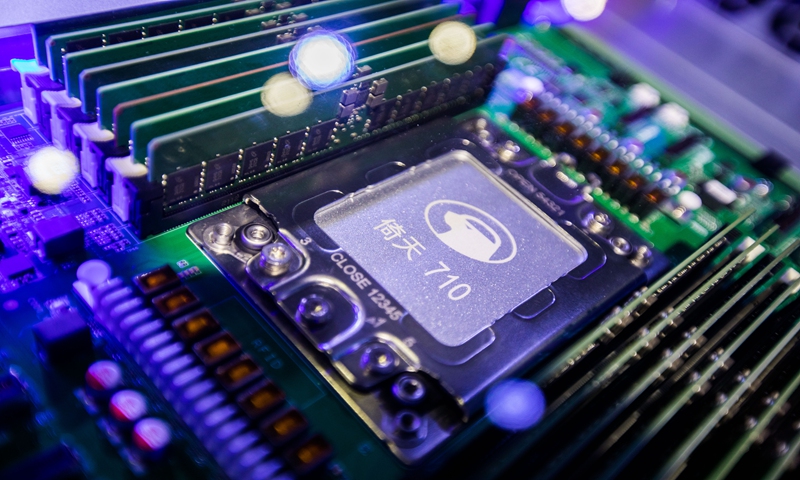

Alibaba’s in-house semiconductor unit Pingtouge unveils self-developed cloud chip Yitian 710 in Hangzhou, East China’s Zhejiang Province on October 19, 2021. Photo: VCG