In late September, as an unusual cold wave arriving weeks earlier than previous years took the country by surprise, many residents in Northeast China were caught off guard by sudden power cuts. In what has been described as the most severe power outages in the country in decades, millions in one of the country’s industrial heartlands were impacted – homes plunged into darkness, heating was turned off and water supply was threatened. Lives were at stake, as nearly two dozen workers at a local metalwork company in Liaoning were sickened by carbon monoxide due to sudden power cuts and were sent to hospitals.

Like the residents in Northeast China, many around the country were also evidently caught off guard by the widespread outages. News of the power cuts took the social media by storm, generating hundreds of millions of views and comments and prompting questions about local governments’ handling of the situation. For many older Chinese, power rationing and shortages were something that existed only in distant memories. For Millennial Chinese, many may not even know such a thing existed.

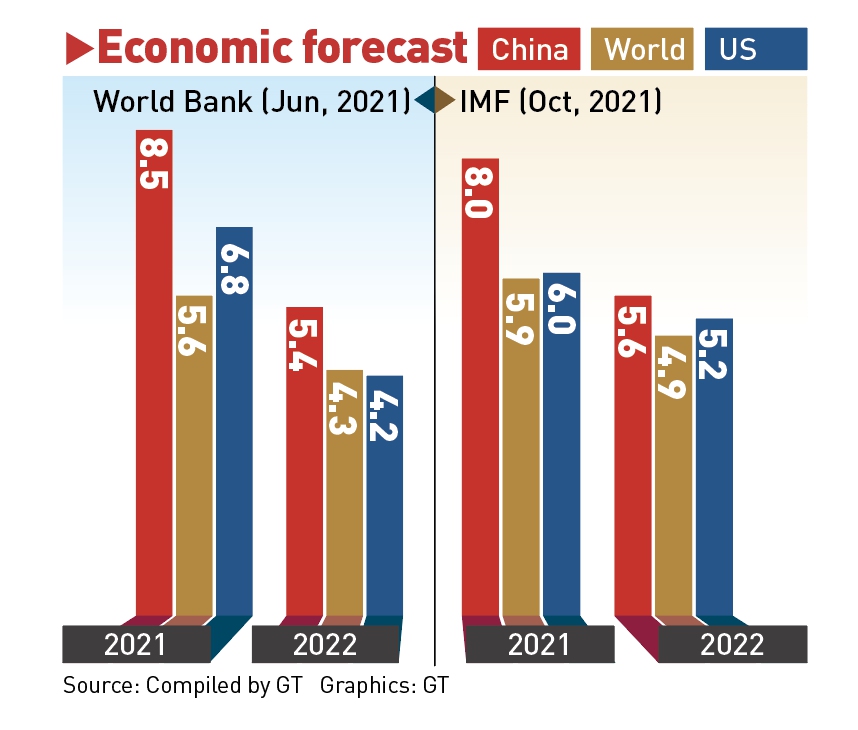

The power cuts in the world’s second-largest economy also became international news. For Western media outlets that have been sparing no effort in finding fault in the Chinese system, this was a golden opportunity. They jumped on the story and portrayed a Chinese government that couldn’t even keep the lights on for its citizens, even though just seven months or so earlier, sustained power outages in the US State of Texas had killed at least 151 people. Foreign financial institutions, including Goldman Sachs, also downgraded GDP growth forecast for the Chinese economy, citing the energy shortages.

However, what happened next would certainly disappoint these China bashers: the Chinese system working at full throttle seamlessly and efficiently. Immediately after the power outages caught attention, multiple measures were employed, various players involved, meetings held, contracts signed, all were aimed at ramping up coal production to save millions of people from the bitterness of winter and factories from halting production from power crunch.

The result: many have moved on, and the power outages again only existed in memories. The “drama” lasted only a matter of weeks. The US and Europe, facing a similar energy shortage issue at about the same time, were still grappling with such issues.

Looking back, 2021 was another tough year for the global economy still reeling from the fallout of the COVID-19 pandemic and combating new emerging challenges. To describe the hardship in 2021 in just one word, it would be “shortage.” On a global scale, there were energy shortages, chip shortages, container shortages, fertilizers shortages, Christmas tree shortages, to just name a few.

In China, which has been mounting a robust recovery from COVID-19, power shortages caused by stretched coal supplies were a very intricate and complex problem that raised questions about energy security, environmental protection goals, economic governance, and even the country’s resilience in the face of mounting challenges and risks.

However, just like the intricacies of the problems, the Chinese system’s response was equally sophisticated and comprehensive, as it touches on many delicate relationships – between the government and market forces, between central and local governments, between short-term challenges and long-term development goals and between state-owned enterprises (SOEs) and private businesses.

In interviews with the Global Times, members of the public, frontline mining workers, companies and industry experts describe a whole-of-society campaign with the participation of all levels of government officials and market regulators, commodity exchanges, state-owned and private mining firms – all coming together so effectively that the power outages were reined in within weeks.

Complex challenges

“In the thick of it, there are six or seven hundred of trucks lining up at a mine I know of, waiting for the coal to be excavated. Drivers live inside the truck for up to four days in order to get our coal to Northeast China, where there is a shortage of the fuel,” a veteran industry insider surnamed Han from Ordos, one of China’s coal capitals and located in North China’s Inner Mongolia Autonomous Region, said, recalling the severity of the matter.

“Starting from September and lasting through November, a severe imbalance between supply and demand in coal has really kicked in,” Han told the Global Times. “Coal prices surged from 500 yuan ($78.47) in normal times to 2,700 yuan at mines and 3,100 yuan at northern Chinese ports.”

Continuously rising coal prices were driving demand for the fuel in a self-reinforcing vicious circle, as buyers from other provinces flocked to coal-producing regions to seek and secure supplies and people who wanted to make a profit out of the crunch joined in.

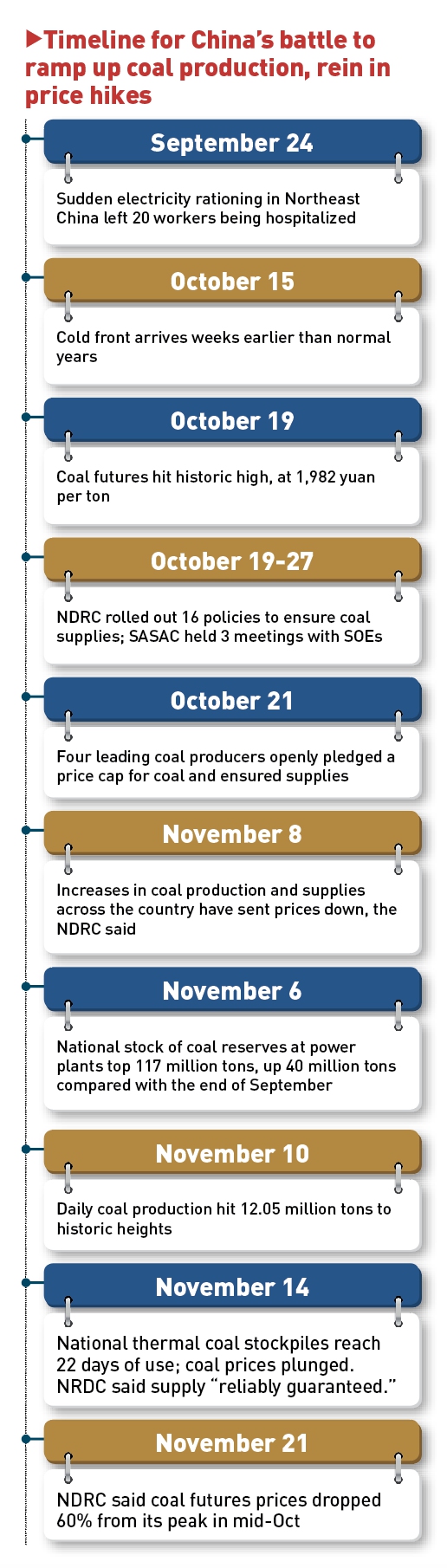

To make the matter worse, a torrential rain has hit Shanxi, one of China’s key coal producing provinces, causing 60 mines to be temporarily shut down. Fueled up by multiple factors, on October 19, the country’s coal futures also reached its peak, also the highest level since the establishment of the commodity market, to 1,982 yuan per ton.

Despite China’s rapid advancement in new-energy and renewable energy source installations in recent years, coal still accounts for about 60 percent of all the country’s primary power generation. And the problems in Northeast China are no separate case. As power demand rises up, in part due to a flow-in of manufacturing activity in wake of COVID-19 pandemic, a number of production powerhouse provinces were, although not facing the cold wave, also experiencing and reporting a shortage of coal.

“I think that coal prices could soar to 3,000 yuan if the government took no action,” said an Inner Mongolia-based coal trader surnamed Yu.

Mobilizing for battle

By October 27, the National Development and Reform Commission (NDRC), China’s top economic planning agency, had rolled out 16 policies papers in just eight days to ensure coal supplies, ramp up coal production and crack down on coal prices. The State-owned Assets Supervision and Administration Commission of the State Council, for its part, held three meetings in two days addressing the same matter.

Starting from October 19, the NDRC issued guidelines to guide coal prices to return to a reasonable level. Multiple inspection teams were dispatched to cities and ports across China to oversee the campaign on the ground.

By October 21, major coal producers had openly pledged to strictly observe a price ceiling for thermal coal and ensure coal supplies.

At the grass-roots level, the policies of the central government were also carried out with efficiency.

In Shanxi, where the impact of a rain flood in earlier October was still being felt, mines were all-in on the ground. After a long period of downsizing in coal mine development and investment, it requires efficient deployment to ramp up production in an effective manner.

Although China is rich in coal, scaling up the output in a short time is by no means easy. Sourcing mechanized mining equipment, arranging personnel and above all, ensuring safety during extraction, are all the issues miners have to face.

In a statement sent to the Global Times by the Shanxi Coking Coal Group (SCCG), the state-owned coal miner in Shanxi depicts how ensuring supply is carried out at ground level.

By orders of the Shanxi Provincial Government, the SCCG is tasked with supplying 5 million tons of coal to Central China’s Henan Province, which neighbors Shanxi; and another 500,000 tons of coal to Northeast China’s Liaoning Province during the fourth quarter, the company said.

It was with resolute execution and absolute efficiency that such assignments were carried out.

In the noon of the day of the assignment, SCCG summoned customers from 55 power plants in Henan to ink 78 supply contracts in four hours. By midnight that day, all resources allocation and contract signing had been completed.

From November 1 to 8, a total of 431,000 tons of coals, or 99 percent of what had been promised to downstream customers at coal-fired power plants, was shipped to Henan via railways, according to the statement by SCCG, which runs 151 mines.

Production safety was not compromised, as coals in Shanxi, different from the open pits in Inner Mongolia, are buried deep under the earth. In the heat of the supply ensuring campaign, daily production reached its highest level in the history of the company to 471,000 tons on October 26.

Five mines under SCCG that were originally downsizing also rapidly intensified trial operations, while relevant mining licenses were still in the process of being applied and some infrastructure work still underway, to ensure the enough coal could be dug out from the mines, and that the output could timely fill up gaps in the inventories as they are shipped away and the chain of supply and demand could be sustained and stabilized.

At Ordos, where the coal mines are open-pit and inflammable gas containment is low, miners could accelerate the pace of coal mining faster than their peers in Shanxi. Yet, according to Yu, the increased output, as deployed at 10 percent, is far from enough to quench the thirst of the market.

Graphics: GT

“I think the most decisive measure during the whole event…is that the government was able to step in, with administrative measures and at the most critical juncture, to place a price curb on coal for the sake of ensuring thermal coal supply,” Yu said.

To create a fair and well-regulated coal market, corresponding measures have been taken by the NDRC as part of a broader government effort to clamp down on illegal profit-making activities such as hoarding and price manipulation.

The financial market regulator and exchanges also weighed in. China Securities Regulatory Commission vowed to curb excessive speculation and malicious capital speculation on coal prices and Zhengzhou Commodity Exchange is also involved.

“We implement the country’s top designs and strive to complete assignments from the central government,” said a source close to the exchange, which hiked trading costs for coal futures to draw away some of the heat of coal trading.

“Reducing liquidity concentrated in coal trading is part of work aimed at ensuring supplies to the market, which will alleviate the pressure of high raw material prices on the real economy,” the source told the Global Times.

Several people spreading false information to fan speculation become subject to police or legal action.

In addition to liberalizing power prices in earlier October, mines were told to supply coals at government designated price of around 535 yuan per ton and the power plants are receiving them at around 700 yuan per ton, a price that is acceptable to them at the moment, Yu said.

The successful crackdown by the government on coal prices cost some people who wanted to make a profit out of the crunch several hundreds of millions of yuan, said Yu.

Graphics: GT

Victory, confidence

With effective approach to ramp up coal production, tackle coal prices, and manage railway transport, the NDRC announced that the stock of coal reserves across the country’s power plants exceeded 117 million tons on November 6, an increase of about 40 million tons compared with the end of September. A phased victory in the campaign against the coal shortage is won.

Officials from the national statistics bureau noted that producer price index in November showed signs of slowing down, and declining coal prices are helping downstream companies to foster a better outlook to the economy.

While there are no shortages of smearing against China’s economic system with criticisms such as “government intervention” and comparisons to the “free market” in the US, after witnessing the Chinese system efficiently tackle challenge after challenge, the Chinese public is increasingly confident about China’s economic governance, especially during times of hardship, analysts noted.

“Sometimes you need to take a fall to learn how to run faster,” Cao Heping, an economist at Peking University, told the Global Times. “Garlic, onions, peas, soy, and coal… the shortage story repeats itself. You never know where the next shortage is and when a new boom-and-bust story ends. But once a problem is exposed [here], it is settled.”

China’s economy also faced a range of other challenges in 2021, including global logistics woes, repeated flare-ups of COVID-19, and a profound economic transition. But just like how it addressed the coal shortages, China’s economic system tackled all the other challenges and risks and is able to ensure that its growth targets will be met.

The Chinese government’s ability to oversee the economy at a macro-level, yet not losing touch on the micro scale is shown here in the battle against coal prices and to ensure coal production. This unique model allowed China to be the first country to shake off the disruption of energy shortages.

Despite recording a slowing growth rate in the third quarter at 4.9 percent, China’s GDP growth will still lead other major world economies, and GDP growth is forecast to reach 8 percent this year, higher than the growth target of “above 6 percent” set by the central government, and higher than the majority of major economies around the world, according to an annual blue book issued by the Chinese Academy of Social Sciences in early December.

The story of fighting a critical supply crunch offers a window into the reasons beneath such strength and momentum.

Looking forward, 2022 will likely be another tough year for the global economy as well as the Chinese economy given the still-spreading COVID-19 and continuing disruptions to global trade, but China’s economic system is best positioned to respond to any new challenges and will likely prevail again, as it did in handling the shortages this year.

Coal piles up at the Port of Rizhao, East China’s Shandong Province on November 28, 2021. China has been ramping up the production and transportation of coal, along with oil and gas as well as renewables, to cope with the winter peak season for electricity. China State Railway Group Co transported 118 million tons of thermal coal from November 1 to 26, up 34.6 percent year-on-year. Photo: VCG