Climbing penetration rate, maturing homegrown players secure market-driven development

As 2021 draws to a close, the Chinese new-energy vehicle (NEV) market, the largest in the world, has been engaged in a heated discussion around the winding down of subsidies in 2022 – and whether the adjustment may hold back the growth of the flourishing industry.

The subsidy scheme, which was first introduced in 2009 to help cultivate China’s nascent NEV sector, has already been an increasingly minor consideration for NEV players over recent years as the NEV industry becomes more market-driven, industry analysts said, noting that the further reduction of subsidies next year won’t have significant impact on the market.

Market-driven evolution

According to the subsidy notice issued by four departments in 2020, subsidy standards for 2020-2022 will be reduced by 10 percent, 20 percent, and 30 percent respectively on levels set the previous year. The rules are applicable to new-energy passenger vehicles priced below 300,000 yuan ($45,700), although the price restriction is not applicable to vehicles with swappable batteries.

The subsidy volume for pure electric vehicles with a range more than 400 kilometers will be reduced by 5,400 yuan in 2022, based on the formula set by policymakers.

The official details for the 2022 subsidy policy are yet to be released.

The government had announced plans in 2015 to end subsidies by the end of 2020, although this deadline was adjusted in March, 2020 amid the outbreak of the pandemic which acutely weakened consumer demand for vehicles.

Over the past 12 years, government subsidies provided to the NEV sector have totaled more than 129.5 billion yuan, covering more than 1,915,900 NEV unit sales. If the recent 18.3 billion yuan in support announced by the Finance Ministry is factored in, cumulative subsidies for NEVs will reach 147.8 billion yuan, according to the Economic Observer.

China’s NEVs include pure battery electric, plug-in hybrid and hydrogen fuel-cell vehicles.

Based on public earnings report, sales volume and other data, most NEV companies that had previously relied on subsidies to survive have now shifted their focus on improving their technology and product competitiveness, while also reducing costs.

Mei Songlin, a senior industry analyst based in Shanghai, told the Global Times on Monday that “the NEV industry is shifting from policy-driven to market-driven, just as saplings take root in the soil, absorb water and nutrients by themselves, and begin to grow organically, instead of relying on external watering and fertilization.”

Despite the current challenges that most domestic automakers face stemming from the soaring price of raw materials and the auto semiconductor shortage, the further reduction of subsidies are adding to their “headache”, Mei said. However, the limiting of subsidies is viewed as a necessary process for the healthy growth of the NEV industry as it has pushed market players to accelerate innovation and develop unique competitive advantages.

Since the beginning of this year, although the overall automobile market has slowed due to an ongoing shortage of chips, NEV sales have shown robust growth compared to the traditional internal-combustion fueled vehicle market.

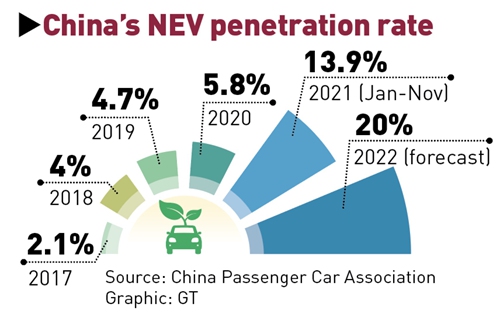

In the January-November period, China’s NEV sales reached 2.51 million units, a jump of 178.3 percent on a yearly basis, NEV market penetration rate hit 13.9 percent, data from the China Passenger Car Association (CPCA) revealed. The penetration rate is expected to surpass 20 percent, the auto industry body forecast.

China has set a target for NEVs to make up 20 percent of auto sales by 2025.

China’s NEV penetration rate Graphic: GT

Potential price hikes

Given the difficulties that automakers face, combined with the imminent lowering of subsidies, each automaker’s response will be a “case-by-case” proposition, auto analysts have claimed.

Cui Dongshu, the secretary general of the CPCA, told the Global Times that automakers have already made preparations, and that different models under different auto brands might have their own answer to subsidy adjustment.

China’s NEV market is growing among a broad spectrum of consumers, with high-end and low-end market demands remaining strong. NEVs priced more than 300,000 yuan are already exempt from subsidies, and the low-end market is subsidized via other methods such as supporting sales in the rural areas. Therefore, it is the mid-to-high-end NEVs which stand to be most affected by the subsidy cut, Cui said.

Some automakers such as Tesla have adopted the most direct approach – increasing prices. In China, the price of the entry-level Model 3 vehicles has increased from 250,900 yuan to 255,652 yuan, while the entry-level Model Y is up from 276,000 yuan to 280,752 yuan.

Photo taken on Oct. 26, 2020 shows the Tesla China-made Model 3 vehicles at its gigafactory in Shanghai, east China. Photo: Xinhua

While some automakers like XPeng have chosen to balance the loss of the subsidy adjustment by not changing its basic car price but through ending favorable buyer credit schemes. Since December 13, most of XPeng models buyers will no longer enjoy zero interest or low interest plans.

The Global Times has learnt that consumers are reluctant to pay for the price increase caused by the subsidy decline although choosing to buy an NEV has become more of the trend. Balancing these forces has become a problem for automakers.

A Beijing-based white-collar worker surnamed Li told the Global Times over the weekend that she recently received an advertising message from a certain automaker, suggesting taking a look of their products and placing an order by the end of the year.

“For me, an electric vehicle with relatively low price and short waiting period for delivery is a good choice, but now I need to pay higher cost in both price and time, I might have a second thought,” she noted.

According to Mei, except for a few strong brands such as Tesla, most NEV brands are unlikely to immediately raise prices, and instead are likely to reduce discounts or incentivized buyer plans.

“The NEV market is going through an explosive stage, and maximizing market share should be the top priority for most auto brands,” he added.

In terms of car sales, in November, sales of Shenzhen-based BYD hit another record high of more than 90, 000 vehicles, continuing to dominate the market, followed by SAIC GM Wuling and Tesla, according to CPCA data.

Employees assemble NEVs at a production line in a workshop in Jinhua, East China’s Zhejiang Province, on December 17, 2021. Photo: VCG