China needs to further accelerate coordination between domestic and international carbon trading mechanisms, and establish national standards that correspond with the development of the international carbon market to enhance the country’s global pricing capability, according to a report posted on the official website of the Shanghai Environment and Energy Exchange (SEEE) on Monday.

The report was written by Zhou Xiaoquan, president of the Shanghai United Assets and Equity Exchange, one of the major shareholders of the SEEE.

According to Zhou, more exploration is needed to establish an international carbon pricing mechanism. For China, this may involve exploring regional carbon market cooperation among Asian countries as well as playing an active role in the practice of carbon pricing mechanisms in the future, according to Zhou.

The national carbon emission rights trading scheme is expected to be built by June, initially covering the power sector, with its annual carbon emission rights quota set at nearly 4 billion tons, meaning it will be top of over 20 global carbon emission rights trading schemes, according to Zhou.

Since 2011, the National Development and Reform Commission has approved trial scheme on carbon dioxide emission rights trading in seven provinces/cities including Beijing, Shanghai, Tianjin, Chongqing, Guangdong, Shenzhen and Hubei.

Shanghai and Wuhan were selected as two centers for the national-level carbon emission trading system, one for trading and the other for the registration of applications and data collection.

The Ministry of Ecology and Environment released details on the “administrative measures for carbon emission rights trading (for trial implementation)” by the end of 2020, signaling that the national-level carbon emission rights trading scheme had entered a new stage. The first contract fulfillment of the national market started on January 1 this year.

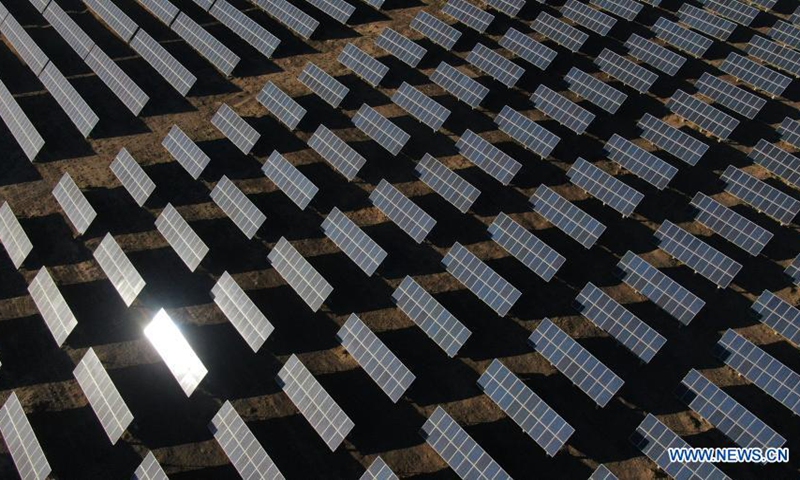

Aerial photo taken on December 15, 2020 shows a view of a photovoltaic industrial park in Northwest China’s Qinghai Province. (Xinhua/Zhang Hongxiang)