India on Monday rolled out its much-awaited 2021-22 fiscal year budget, with one of the highlights centered on sharply boosting infrastructure expenditure. In line with its existing policy framework, the infrastructure spending boost is expected to contribute to its economic growth in the long term. However, the country still needs to take an open mind toward international cooperation and foreign investment.

A new Development Finance Institution (DFI), with starting capital of $2.7 billion, will be set up in India to help fund large-scale infrastructure projects, reported BBC, adding that the “overall spending on infrastructure is up sharply by 35 percent.”

The Indian economy, after going through an unprecedented rout of deep recession of more than 8 percent in the current fiscal year, is expected to see a massive rebound in 2021-22. In a bid to boost the recovery, racking up fiscal spending on infrastructure is within expectation as it could shore up one of nation’s long-existed shortages and, facilitate New Delhi’s wish of joining the “$5 trillion GDP club.”

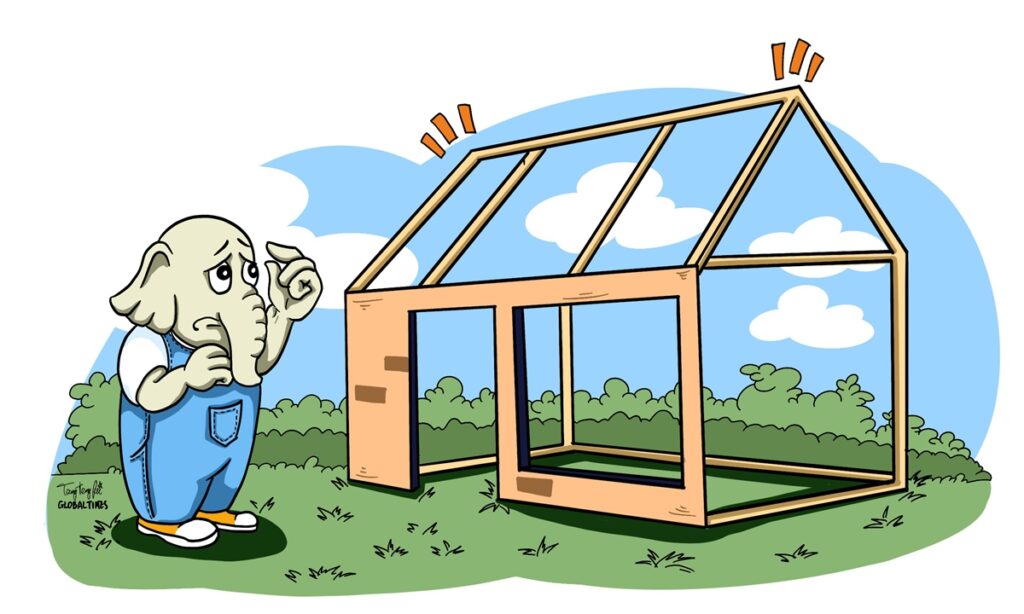

Insufficient infrastructure has been one of the major development bottlenecks for India, which has been holding back the nation’s development, from the growth of domestic industries to attracting foreign investment.

As well-intentioned as it is, boosting infrastructure investment may not be an easy task for the Modi administration. For starters, the Indian economy has been one of the hardest hit economies by the Covid19 pandemic, further weakening New Delhi’s coffers.

According to the budget statement, India’s fiscal deficit in 2020-21 is forecast to rise to 9.5 percent of GDP. Funding massive investment of infrastructure project will be a heavy lift for New Delhi.

In the meantime, India has seen a narrowing path of development in recent years due to the accelerating influence of its domestic plutocrats, with many industries now captive to a handful of powerful conglomerates. Small businesses and the poor have effectively been excluded from the country’s economic growth. Moreover, the domestic plutocrats, with growing political influence, have been prompting the country to adopt unfriendly attitude toward foreign investment.

For instance, Chinese investments and contractors, which facilitated India’s infrastructure construction in previous years, have encountered heavy-handed crackdowns. It may be inevitable for the trend to be extended to India’s new boosting infrastructure campaign.

Without adequate competition, not only will infrastructure construction deliver poor returns, the effectiveness of rebooting economy during post-pandemic era through the infrastructure approach will also fail to meet expectations.

Besides the infrastructure approach, there are multiple sectors that are needed to be addressed by India so as to effectively pull its economy out of the quagmire, including coronavirus containment and foreign fund attraction.

It is crucial for New Delhi to face reality and adopt a more open attitude toward international cooperation and foreign investment. Global value chains and the global division of labor is a dynamic and complex arena, which is hard to be resisted or obstructed by any single force. Only by taking a pragmatic approach to involve more into regional or global value chain, can the Indian economy be fundamentally rebooted, and attain sustainable growth.

The author is director of the Research Department at the National Strategy Institute at Tsinghua University. bizopinion@globaltimes.com.cn

Illustration: Tang Tengfei/GT