China’s GDP is expected to expand above 2 percent in 2020, as the only major economy to grow in positive territory while other economies are still being hammered by the global pandemic outbreak, analysts said.

The robust economic rebound is a vivid display of how the world’s second-largest economy pulled off a monumental effort to successfully control COVID-19, enabling its factories to start roaring again in first place and supply essential materials to the world, and how its pent-up consumption demand climbed from the bottom with stimulus measures kicking in.

Although sporadic coronavirus outbreaks have been reported in the north and northeast part of the country, economists are confident that China’s GDP is on track to grow above 7.5 percent this year. That speaks a lot for the world, not only in terms of the country’s increasing consuming power in addition to its manufacturing capability, but more importantly, the sheer size of economic expansion is estimated to lift the global economy by 1 percent in these two years, analysts said.

China is scheduled to release its GDP data as well as other key economic indexes -including fixed-asset investment, industrial value-added, retail sales and unemployment rate – for 2020 at 10 am on Monday.

Analysts widely expect that China’s GDP will increase at least 2 percent in 2020, with data on December surprisingly on the upside. The 2-percent growth rate would translate to an economic output gain of around 2 trillion yuan ($309 billion) from 2019, the equivalent to the GDP of Chile in 2019, which is the world’s 43-largest economy.

That would also make China the only major economy in the world not to have contracted in 2020.

According to an IMF report released in early January, China’s GDP is estimated to grow at around 2 percent in 2020, while the GDP of developed economies as well as emerging and developing economies could plunge by 5.4 percent and 2.6 percent, respectively. In particular, US GDP is predicted to contract by 3.6 percent in 2020.

Yu Miaojie, deputy dean of the National School of Development at Peking University, told the Global Times on Sunday that China’s swift economic recovery is helpful to narrow the economic gap with the US, the world’s largest economy.

“In 2020, the volume of China’s economy could reach about 70 to 71 percent of the US,” Yu noted. A UK-based think tank also made a bold projection that China could surpass the US economy by 2028.

China’s shares in the world economy, as a result, will rise substantially. According to a forecast by Moody’s Analytics, China’s economy in 2020 is estimated to account for 16.8 percent of the world’s, improving from 14.2 percent in 2016.

Through the supply of daily necessities and personal protective equipment, China also made another significant contribution to the world: it mitigated inflation spurred by potential global shortages, Tian Yun, vice director of the Beijing Economic Operation Association, told the Global Times on Sunday.

“Without China’s supply input, global inflation would rise by about 1 to 2 percentage points,” Tian said.

Breaking down the figures, China’s retail sales are likely to have achieved positive growth last year, according to a research note chief China economist at UBS Wang Tao sent to the Global Times. Fixed-asset investment is estimated to increase by above 4 percent

China’s exports grew 3.6 percent to $2.59 trillion, while imports edged down 1.1 percent to $2.06 trillion in 2020, customs data showed on Thursday.

“The key to China’s economic reboot lies in a better-than-expected export performance, mainly thanks to China’s systematic advantage that curbed the spread of the deadly virus in the early stage and paved the way for quick manufacturing resumption,” Tian said. He stressed that the sharp contrast between China and other countries’ economic performance laid bare the gaps in how a country handles the coronavirus.

In the third quarter of 2020, China’s GDP gained 4.9 percent, after a 3.2 percent growth in the second quarter before touching the bottom with a slump of 6.8 percent in the first quarter.

A promising 2021

Analysts expect China’s GDP to grow by more than 7.5 percent in 2021, the fastest among the top 10 economies.

Nevertheless, new coronavirus cases in northern China, which have disrupted traffic and industrial activities in the north, may cloud the country’s economic recovery in the short-term, analysts noted.

“It could drag down GDP growth in 2021 by 0.1 to 0.2 percentage points, but never would a tragedy similar to the beginning of 2020 happen again,” Tian stressed.

This year marks the first year of the 14th Five-Year Plan (2021-25) period. In the new year, a new round of opening-up – the establishment of the Hainan Free Trade port, signing the Regional Comprehensive Economic Partnership as well as finalizing negotiations on the China-EU bilateral investment treaty agreement – as well as a steady boost of the Belt and Road Initiative will further cement China’s standing in global industrial, supply and value chains, experts noted.

Wang from USB said that a strong global recovery would help China’s exports surge by an estimated 10 percent in dollar terms in 2021.

Meanwhile, China will be moving to become more reliant on domestic consumption under a “dual circulation” development pattern that emphasizes the need for the domestic market to act as the mainstay, to be supplemented by the international market.

“China’s consumer market will keep gaining momentum with the progress of mass vaccination, fueling a new round of foreign investment inflow to the nation who bets big in the market,” Tian noted.

Analysts suggest Chinese policymakers should closely monitor the foreign exchange rate policy, as a drastic appreciation in the yuan against the US dollar could erode manufactures’ profit margins.

Also, tax and fee cuts are also necessary to increase people’s disposable income, while monetary policy needs to remain “moderately loose” to release liquidity to the market when necessary, according to Tian.

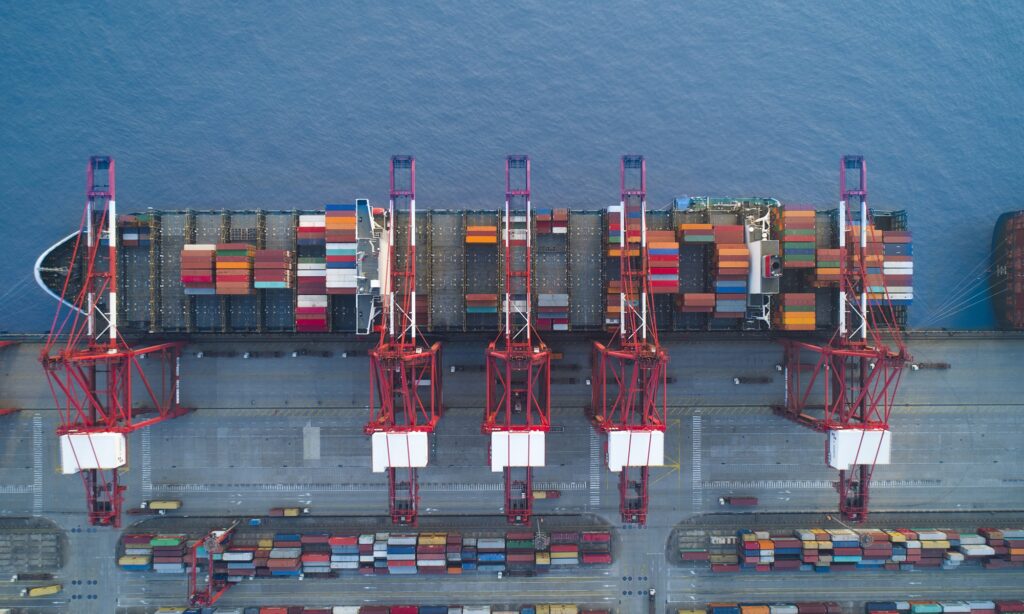

GDP Photo: VCG