An industry watchdog has released a draft rare-earth management rule on Friday, including quota management of domestic rare-earth production, investment management and supervision, which analysts said is a sign that China vows to standardize management of the rare-earth industry and promote high-quality development of the industry.

The draft includes 29 articles, clarifying the total quota control over rare-earth mining, smelting and separation, and the approval system for investment projects of rare earths. It also emphasizes the strengthening of the management of the whole industrial chain and supervision, according to the Ministry of Industry and Information Technology (MIIT) on Friday.

According to the draft regulation, China’s State Council will set up a coordination mechanism for rare-earth management, tasked with rare-earth policymaking.

“The draft can be seen as a regulation to further strengthen management, standardize the order of the industry, the core of which is total volume control. The quota control actually started in 2006,” Chen Zhanheng, deputy head of the Association of China Rare Earth Industry, told the Global Times on Friday.

But another analyst said that although the quota control started early, there was no strict regulation and tight supervision, which the new rule fills.

“The draft puts protection first, covering production and market circulation. It is conducive to stabilizing the rare-earth market, and will play an important role in safeguarding the security of the strategic resources, in ecological and environmental protection,” a rare-earth analyst of cnfeol.com surnamed Yuan told the Global Times on Friday.

Yuan added that rare earths play an irreplaceable role in many fields such as electronic screens, optical fiber communications and superconducting materials.

In terms of the export, analysts said there will be some impacts.

China’s exports of rare earths have been decreasing in recent years. The total export of rare earths was down to 35,447.5 tons, or 23.5 percent year-on-year in 2020, China’s customs authority said on Thursday, registering the lowest figure since 2015.

Liu Enqiao, a senior energy analyst at the Beijing-based Anbound Consulting, said that the drop in rare-earth exports is partly the result of China’s efforts to upgrade the sector, encouraging more high-end production and reducing exports of rare earth ore raw materials.

“Rare earth ore exports are limited in value, and the global demand for raw materials is relatively low. China has been working for years to add value in the production chain of rare-earth products, especially in encouraging more intellectual property rights around rare-earth production technologies,” Liu said.

Liu also noted that the fluctuations in the export volume of rare earths might be partly due to China’s tightening of regulations on strategic resources.

A new Chinese law introduced in December will restrict exports of controlled items, which experts said will increase market supply volatility of some products and technologies, including rare earths.

The law, passed by the country’s top legislative body in October, stipulates that China will impose restrictions or bans on exports of military and nuclear products, as well as other goods, to protect the national interest and security.

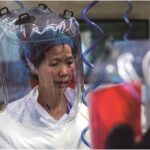

A worker unloads rare earths along the Yangtze River’s banks in Southwest China’s Chongqing Municipality on May 9. Photo: IC