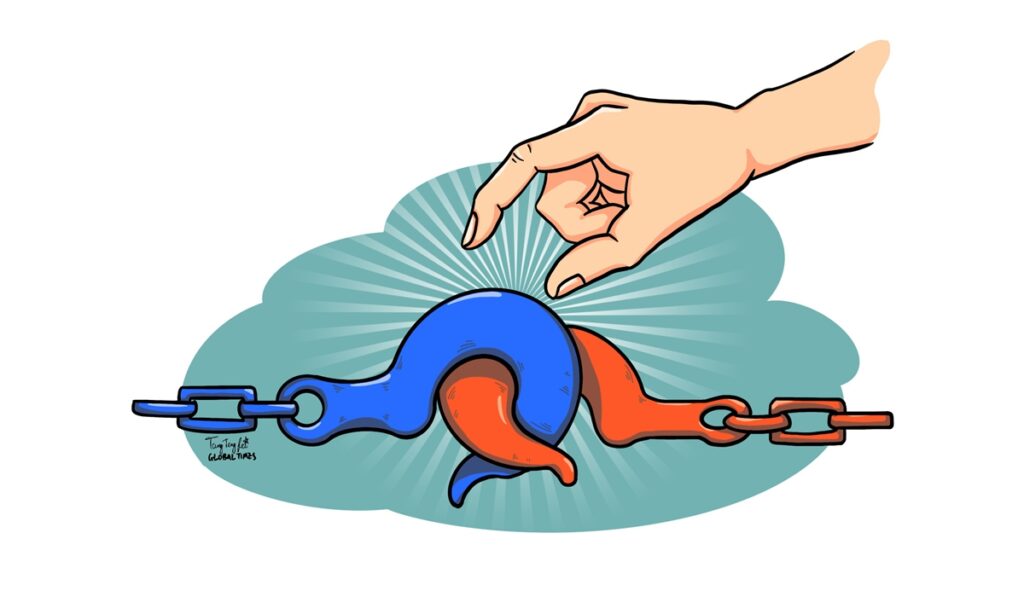

For some time, the Trump administration has tried hard to promote the “decoupling” of Chinese and US economies, disrupting normal economic cooperation between the two nations. As the transition of power in the US continues, many people wonder that whether the incoming Joe Biden administration will maintain Trump’s decoupling strategy?

The “decoupling” of the two leading economies runs counter to the global trend of economic integration and is not a winning strategy with the public at all.

Decoupling threatens existing trade cooperation between China and the US. The two countries have become critical trading partners for many years. In 2019, despite economic and trade frictions provoked by the US, resulting in a 14.6 percent drop of bilateral trade from 2018, the volume of trade in goods between China and the US still reached $541.2 billion, almost equivalent to the annual GDP of Sweden.

In December 2019, China’s imports from the US increased by 9.1 percent to hit 78.83 billion yuan. Despite the serious impact the pandemic has had on global trade since the beginning of this year, China’s imports from the US amounted to 725.65 billion yuan from January to October, an increase of 5.2 percent.

In addition, despite China’s trade surplus against the US, 90 percent of the profits derived from Chinese manufactured goods are made by American companies, while the profits of Chinese manufacturers are as low as 2-3 percent. Thus, it is not China that “takes advantage of the US.” On the contrary, China is playing a vital role in the rebound of the US economy, at a time when global trade has contracted.

During the recently concluded third China International Import Expo, 197 US exhibitors presented 1,373 commodities, ranking No.1 among all 135 exhibiting countries. Chinese and American economies are highly intertwined. If the US unilaterally restricts trade, it will not only cause heavy losses in the agricultural, industrial, and energy sectors, but also seriously disrupt global supply chains and have a major negative impact on the income and livelihood of American farmers, workers and it ordinary citizens.

Decoupling will hurt American companies. Despite the China-US trade frictions, US companies remain ready to invest in China. According to a recent survey published by the US-China Business Council, notwithstanding the adverse effects of China-US economic and trade frictions, more than 90 percent of US companies have no plans to leave China, with more than 83 percent of the US companies regarding China as one of their most important markets globally. Total US investment in China in US dollar terms has increased by 6 percent in the first half of this year.

The International Monetary Fund (IMF) predicts a 4.4 percent drop across the global economy in 2020. Among the major economies, the US is forecasted to decline by 4.3 percent. China will be the only major economy to achieve positive GDP growth. Against this backdrop, will American companies be willing to abandon China based on political considerations?

Decoupling will deprive Americans of domestic jobs. For a long time, the US has been the country with the largest utilization of foreign capital, and foreign investment remains a crucial factor bolstering the economy and its employment. The amount of Chinese direct investment in the US surpassed that of US direct investment in China for the first time in 2012. From 2000 to 2014, direct investment by Chinese companies in the US reached $46 billion, creating more than 80,000 jobs in the US.

The US-China Business Council reported that bilateral trade and reciprocal investment created up to 2.6 million jobs in the US in 2015 and contributed $216 billion to the US economy, equivalent to 1.2 percent of the US GDP. At a time when global overseas investment is undermined by the pandemic, Chinese enterprises continue to achieve growth against the headwinds in the US through mergers and acquisitions, contributing to the recovery of the US economy, and more importantly, saving the jobs of many Americans.

In addition, more than 3 million Chinese tourists visit the US every year, with the highest per capita consumption in the world. About 420,000 Chinese mainland students are studying in the US, making it the largest group of foreign students there and contributing $14.9 billion to the US economy from 2018 to 2019. Decoupling ultimately means Americans will have to sacrifice these gains.

Decoupling will damage US currency. The US has built an economic superpower backed by its wealth and the US dollar’s global reserve currency status, and China plays a vital role in supporting the dollar’s position.

With further opening up of China’s financial sector, a good number of Wall Street companies and capital have flowed into China in the past two years. In 2019, foreign fund management companies have bought more than $200 billion shares and bonds in China.

The Financial Times recently published an article titled “Ignoring political tensions, Wall Street ploughs the Chinese market,” revealing the fact that despite the current China-US political tensions, Wall Street’s most powerful financial institutions are speeding up efforts to strike deals in China.

According to the US Congressional Budget Office, total US debt reached 98 percent of its GDP in fiscal year 2020, the highest level since World War II, dragging the US into a new debt crisis. How government addresses this enormous deficit and generates further financing has become an issue that officials cannot shy away from, as it will ultimately have an impact on whether US credit and the US dollar’s position as the global currency will remain viable.

China is the second-largest creditor nation of the US, holding $1.06 trillion US Treasury bonds. China’s US dollar foreign exchange reserves have reached $3.18 trillion. China’s “vote of confidence” in the US dollar and US dollar assets is critical to keeping the dollar’s global position.

No matter what US politicians engage in political maneuvering, “decoupling” of the two giant economies is doomed to fail. China’s development and global economic integration are trends which are unable to be reversed. Any attempt to “decouple” from China is to “decouple” from the world’s largest market in waiting. Biden’s election win represents a unique opportunity to reset fraught bilateral relations.

The authors are observers for international issues. bizopinion@globaltimes.com.cn

Illustration: Tang Tengfei/GT

Global Times