Wang Shiyuan, from Shanghai, can still remember clearly that he sipped his first coffee at a Hilton hotel in Jing’an district in the 1990s.

“I was so impressed to see the Christmas decorations at the hotel, for there were miniature villages and electric trains running through them. In that era, it had the most aesthetic and festive place, even better than any amusement park in my view,” Wang told the Global Times.

Amazed with foreign-invested hotels, Wang visited almost all the high-end hotels in Shanghai, and the past experience in his youth also became an important reason for him to become a popular travel blogger now.

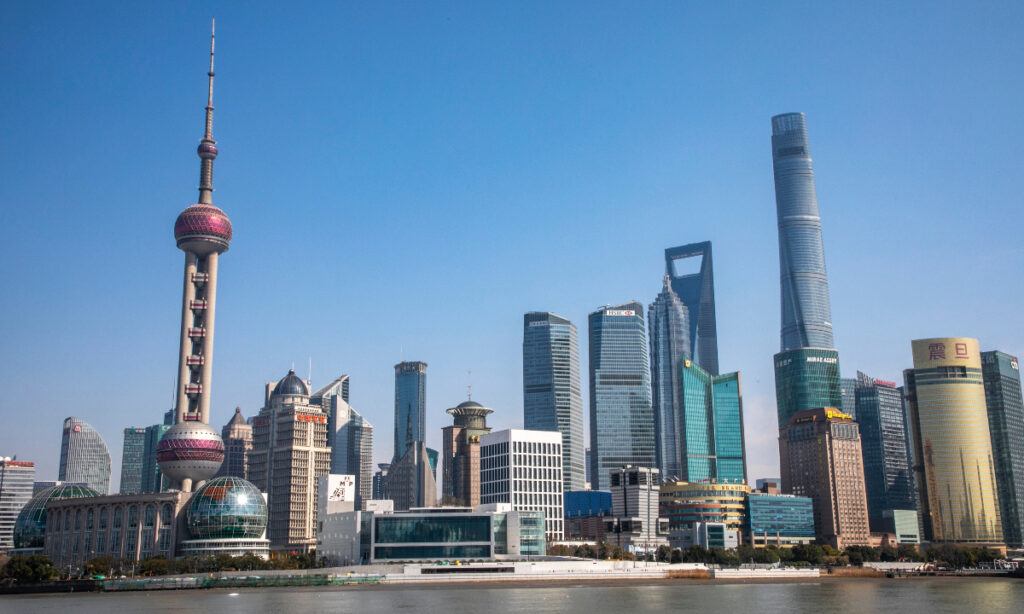

“Now, when I go out for a jog along the Huangpu River, I always measure my distance with the hotels. When Mandarin Oriental located in Pudong and Banyan Tree Shanghai on the Bund appear on my left and right hands, I know I just run two kilometers, and the one kilometer from Banyan Tree to hotel W is the most tiring but with the most beautiful view,” he said.

The pace of opening-up of China is synchronized with the development of high-end hotels, and those foreign players belong to the first batch of beneficiaries of China’s reform and opening-up.

Now, foreign-funded hotels say that, despite various short-term challenges, they will actively adapt to the new trends in China’s economic development and continue to cultivate the hotel market with localized strategies, and are expressing strong confidence in the Chinese market.

More hotel openings

The latest example is that Hilton Group recently announced the opening its 700th hotel in China with the opening of Conrad Hotel in Southwest China’s Chongqing Municipality after launching its 600th hotel in China in December last year.

“We will continue to expand its Chinese market at a rate of launching a new hotel every three days,” Qian Jin, president of Hilton Greater China and Mongolia region, told the Global Times via E-mail.

“This year, we will achieve a development speed of opening more than 100 new hotels in the Chinese market every year for the fifth consecutive year, fully reflecting our commitment and determination to expand our operations in the Chinese market,” Qian added.

Qian’s remarks followed the government’s concrete measures to boost domestic consumption including the travel business.

Official statistics indicate that during the first six months this year, the number of domestic tourist trips in China soared to 2.725 billion, marking a 14.3-percent growth compared to the same period last year.

In addition, the cumulative spending by domestic tourists hit 2.73 trillion yuan ($382.52 billion), a 19-percent increase from the corresponding period in 2023.

And, the nation witnessed an influx of more than 14.6 million overseas visitors in the first half year, an impressive increase of 152.7 percent year-on-year.

Industry insiders said that China’s tourism market has obvious advantages to expand, thanks to the government’s visa-free travel policy, bringing an increase in inbound tourism.

The hotel industry in China is marching into a fast recovery track since last year, Li Bin, professor of tourism science at Beijing International Studies University, told the Global Times, and he said that the expanding visa-free travel policy has been an impetus to lift hotel business.

The visa-free policy has a driving effect on those foreign-invested hotels, mid- to high-end hotels in particular, which accommodate mostly foreigners, Li said.

IHG Hotels & Resorts said in the first half of the year, the number of new hotels opened in Chinese mainland increased by 49 percent year-on-year.

Daniel Aylmer, chief executive officer of IHG Greater China region, said that the fundamentals of the Chinese market remain very strong as it has the world’s largest travel population base, diverse tourism facilities and comprehensive government policy support.

“We are optimistic about our long-term development in China,” according to Aylmer.

Expanding to hinterland

In recent years, the rapid rise of China’s domestic hotel groups such as Huazhu Group and Atour has brought a lot of challenges to international hotel groups, including their mid-to-high-end product lines, according to Wang.

After the COVID-19 pandemic, inbound travel has gradually recovered, and international hotel brands are largely maintaining its advantages with their stronger international influence and membership system.

Chinese experts and market analysts noted that expanding into China’s hinterland cities has become the strategy for many global hotel players.

Although China’s consumer spending is experiencing a swift recovery after the pandemic, domestic demand has yet to reach the levels it enjoyed prior to the pandemic, according to Chinese officials.

Whether domestic or foreign, the inland market is “must compete” for them if they enter China, said Li, from Beijing International Studies University. “The hinterland is what we often call the fourth- and fifth-tier cities, or the county-level cities, which have also attracted many hotel players to start their business. It means that as the country accelerates its urbanization pace, more opportunities will emerge,” Li said.

China’s Foreign Ministry spokesperson Mao Ning said on Friday that the country will further relax market access, expand active opening-up, and unilateral opening-up to the least developed countries, so as to “enlarge the cake of openness, extend the list of cooperation, and promote global openness.”

With its large market, complete industrial system, and favorable business environment, China’s development will inject more vitality into the global economy, Mao said.

According to Mao, China’s economic growth has been among the top in major economies for years, with its contribution to the world economic growth standing at around 30 percent. China has also become the main trading partner for more than 140 countries and regions. Mao noted that the Chinese economy has maintained a stable and progressive development trend this year.

GT